Oct 23, 2019

Global Economy Heading Toward "Manufacturing Slump"

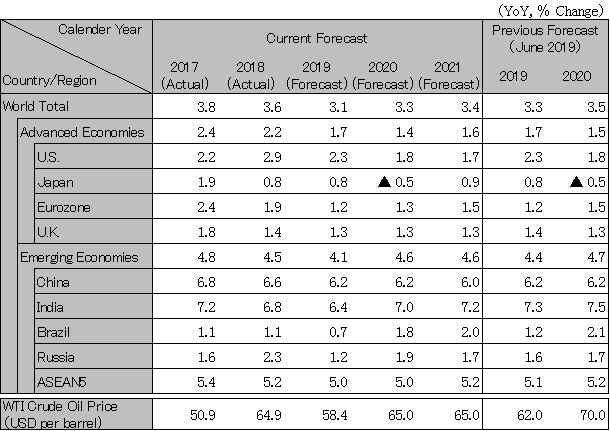

The global economy entered a cyclical downturn in spring of 2018 in manufacturing industries such as IT and automobiles, and this has been further compounded by headwinds such as prolonged US-China trade tensions and the rising possibility of a no-deal Brexit. As a result, global economic growth appears likely to slow from 3.6% in 2018 to 3.1% in 2019 and recover only slightly to 3.3% in 2020. Growth rates for the Apr-Jun quarter of 2019 in China (6.2% year-on-year on annualized basis), the euro zone (0.8%), the US (2.0%), and Japan (1.3%) were all lower than those for the Jan-Mar quarter, indicating a clear slowdown in growth across all major economies.

Even if tariffs imposed between the US and China are expanded to include almost all products in December 2019, the ensuing drag on consumer spending from reduced purchasing power would only be equivalent to 0.3% of GDP in the US and 0.1% in China. However, uncertainty regarding the outlook on tariffs would likely cause companies to hold off on capital spending, and this is fueling concern for economic recession in the US.

Growth will likely slow from 2.9% in 2018 to 2.3% in 2019 and 1.8% in 2020. With manufacturing activity shrinking and the spread between short- and long-term interest rates on government bonds reversing, market participants are concerned about the economic outlook. The economy has been driven by solid consumer spending amid a favorable employment and income environment. However, the fourth round of tariffs against China ($110 billion from September 2019 and $160 billion from December 2019) include many consumer goods, for which the US depends heavily on imports from China, and there is concern that this may suppress consumer spending. In terms of monetary policy, the FRB cut interest rates in July and September and is expected to carry out a further rate cut in December. The federal funds interest rate (upper limit), which stood at 2.5% at the beginning of the year, will likely fall to 1.75% by the end of the year. A decline in long-term interest rates in anticipation of the FRB's monetary easing should prevent a recession, but the US’s potential growth rate will likely fall to the upper 1% range in 2020, partly due to supply constraints.

The euro zone's growth rate will likely slow from 1.9% in 2018 to 1.2% in 2019 and 1.3% in 2020, below the potential growth rate in the mid-1% range. Regional powerhouse Germany, whose economy is heavily dependent on exports, has seen production slump in its manufacturing industry due to slowing exports to the UK and China as well as sluggish global demand for automobiles. The economy appears to be on the brink of a recession, with growth of just 0.6% forecast for 2019. The ECB cut interest rates and resumed quantitative easing in September 2019, but these moves have had little additional effect. It has also been slow to transition toward expansionary fiscal policy, and the euro zone as a whole remains on the brink of recession.

In the UK, growth will likely slip from 1.4% in 2018 to 1.3% in both 2019 and 2020, with the potential growth rate, which was around 2% in the past, falling to the lower 1% range. It appears likely that the deadline for the UK’s withdrawal from the EU will be extended to the end of January 2020 and a general election held some time after the end of October 2019. However, it is also still possible that Prime Minister Boris Johnson will force a withdrawal without an agreement at the end of October.

Due to deleveraging (debt reduction) to reduce financial risk, a decline in IT demand, and tensions between the US and China, growth will likely slow from 6.6% in 2018 to 6.2% in both 2019 and 2020. With economic stimulus measures aimed at boosting consumer and corporate spending through tax cuts and electricity rate reductions proving largely ineffective, China is still struggling to arrest a slowdown in infrastructure investment and a decline in automobile sales. The government plans to increase spending on infrastructure projects such as remodeling of old housing complexes. Even if interest rate cuts cause the yuan to weaken to levels in excess of 7 yuan per dollar, tightened capital controls should prevent sharp depreciation in the yuan. With the government planning to persist with measures to limit financial risk and transform China’s economic structure, the slowdown in the overall economy may end in 2020, but the country’s manufacturing sector will probably continue to lose steam.

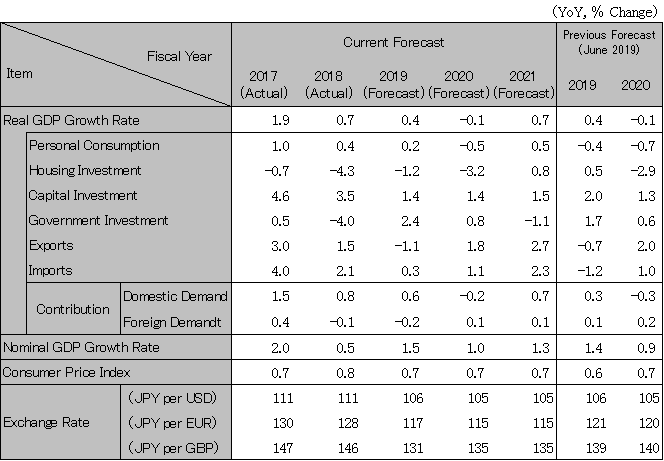

Growth in industrial production has slowed due to declines in exports, particularly to China and other Asian countries. The manufacturing sector has curbed capital spending in fiscal 2019 due to deteriorating earnings. Consumer sentiment is worsening due to sluggish income growth. The consumption tax hike carried out against this backdrop in October 2019 will probably trigger a recession in the second half of fiscal 2019. The government plans to allocate 2.0 trillion yen to economic stimulus measures in its supplementary budget for fiscal 2019, but the ensuing effects are unlikely to emerge until mid-2020 or later. Growth will likely slip from 0.7% in fiscal 2018 to 0.4% in fiscal 2019 and -0.1% in fiscal 2020. Whereas the FRB still has room for interest rate cuts, the Bank of Japan has little scope for further monetary easing, and the yen could strengthen further if interest rate differentials narrowed amid a US economic recession.

Note: The figures above are calendar-year based. Accordingly, the figures of Japan are different from the fiscal-year based figures in the table below.

Note: The figures above are calendar-year based. Accordingly, the figures of Japan are different from the fiscal-year based figures in the table below.

We provide you with the latest information on HRI‘s periodicals, such as our journal and economic forecasts, as well as reports, interviews, columns, and other information based on our research activities.

Hitachi Research Institute welcomes questions, consultations, and inquiries related to articles published in the "Hitachi Souken" Journal through our contact form.