Mar 13, 2020

Growing Risk of a Pandemic-induced Recession

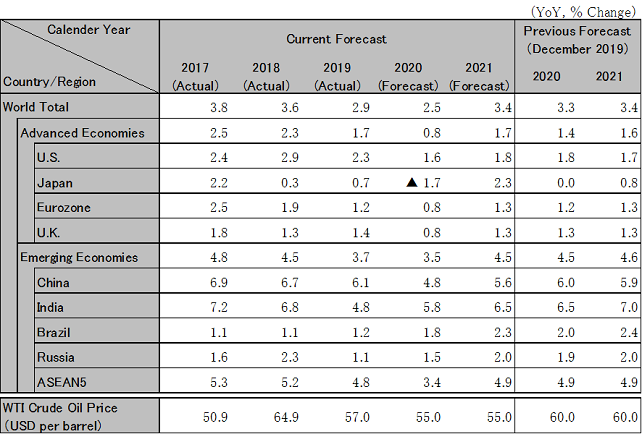

Global economic growth stood at 2.9% in 2019 and is forecast at 2.5% for 2020, which would put us on the brink of a global recession (growth below 2.5%). The forecast of 3.4% for 2021 also suggests a slow recovery. Signs of a bottom for manufacturers in major countries were emerging in January 2020, but this was followed by an abrupt slowdown in February due to the impact of the new coronavirus. The virus has since evolved into a pandemic, with infection spreading across multiple continents.

Production and consumption declined in Jan-Mar 2020 due to factory closures and restrictions on going out in public in China. Other countries such as South Korea and Japan, which have followed China’s lead in implementing emergency measures, will likely see consumption decline in Feb-Apr as people refrain from going out and consumer confidence weakens. Even the US and Europe, which are yet to implement emergency measures on a nation- or region-wide basis, have seen a growing impact from reduced inbound demand as well as a decline in exports to these countries and regions. For emerging markets, growth will likely fall from 3.7% in 2019 to 3.5% in 2020, marking two consecutive years of growth below 4%. Exports to China are declining, and there have been delays in the supply of components and materials for automobiles, machinery, and textiles in Southeast Asia, while resource-rich countries are being hurt by falling resource prices.

The Fed’s February 2020 survey found that consumer sentiment was strong amid a solid labor market, but stock prices and long-term interest rates fell in the last week of February due to financial market concerns about the impact of the new coronavirus. The Fed made an emergency rate cut on March 3, 2020, lowering its benchmark interest rate by 50 basis points. A further 50-basis-point cut is expected in the first half of 2020 (brining the upper end of the federal funds target range to 0.75%, down from 1.75% prior to the emergency rate cut). Since February, consumer spending has slumped as a result of delays in the supply of smartphones and other products due to supply chain disruptions, as well as weakened consumer confidence amid concerns about the spread of the coronavirus. While the Fed’s interest rate cut has stimulated housing investment and averted a recession, economic growth will likely slow to 1.6% in 2020, below the potential growth rate.

In Germany, production, which had been sluggish due to a decline in exports, was bottoming out as inventory adjustments progressed. However, the impact of the coronavirus has caused exports to China to fall, and a global decline in automobile demand is also taking a toll. Economic growth will likely slow further, from 0.6% in 2019 to 0.2% in 2020. Italy, which is implementing emergency measures to curtail the spread of the coronavirus in its cities, will likely enter a recession in 2020. Growth for the eurozone as a whole will likely slow from 1.2% in 2019 to 0.8% in 2020 before recovering slowly to 1.3% in 2021, assuming that the spread of the coronavirus from Italy to other areas in Europe is prevented.

Authorities in China have implemented emergency measures such as closing off Hubei Province, placing restrictions on going out in public in locations such as Beijing, and restricting business resumptions in areas throughout the country. As a result, the spread of the new coronavirus has slowed since mid-February, but economic growth will likely slump to 2.5% for Jan-Mar 2020. Production should gradually recover to pre-Lunar-New-Year levels from Apr-Jun, when the coronavirus’s impact will likely peter out, before increasing in the second half of the year as a result of efforts to make up for inventory shortages in electronics and certain other industries. On the demand front, consumption will probably remain sluggish in 2020, as measures such as those to promote automobile sales will likely have limited effect in stimulating consumption.

Since mid-February, the authorities have shifted from focusing primarily on measures to counter the coronavirus, instead instructing local governments not to impose excessive restrictions on business resumptions, while also offering financial support to SMEs and implementing economic stimulus measures such as expanding infrastructure spending by pushing forward municipal bond issuances. As a result, sluggish growth of 4.8% is forecast for 2020, followed by 5.6% in 2021, which would represent a recovery to a level around the country’s potential growth rate.

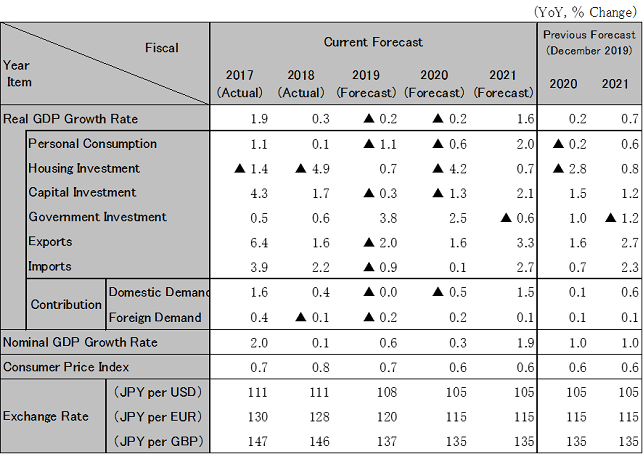

The new coronavirus presented an additional drag just as year-on-year growth had slumped to –7.1% in Oct-Dec 2019 due to the impact of the consumption tax hike. In Jan-Mar 2020, factory closures and production cuts in China have led to supply chain disruptions, while inbound demand has fallen and exports to China have declined. In addition, emergency measures to prevent a further spread of the coronavirus have led to reduced business activity, and service consumption has plunged as a result of people avoiding non-essential gatherings. A year-on-year decline of 7.1% is forecast for Jan-Mar, which would represent a second successive quarter of negative growth, indicating a recession. Economic growth should return to positive territory as the effects of economic stimulus measures approved the Cabinet in December 2019 (\3 trillion on net basis), which are centered mainly on public works, emerge from Apr-Jun. However, amid lingering concerns about new coronavirus cases, the pace of recovery will probably be sluggish, with consumer confidence unlikely to strengthen notably even amid a boost from the Tokyo Olympics and Paralympics in July to August. Negative growth of 0.2% is forecast for both fiscal 2019 and fiscal 2020, followed by a recovery to growth of 1.6% in fiscal 2021.

Note: The figures above are calendar-year based. Accordingly, the figures of Japan are different from the fiscal-year based figures in the table below.

Source: IMF. Forecast by Hitachi Research Institute.

Source: Japan Cabinet Office, etc. Forecast by Hitachi Research Institute.

We provide you with the latest information on HRI‘s periodicals, such as our journal and economic forecasts, as well as reports, interviews, columns, and other information based on our research activities.

Hitachi Research Institute welcomes questions, consultations, and inquiries related to articles published in the "Hitachi Souken" Journal through our contact form.