Jul 8, 2020

Lingering Risk of a Double Dip Recession after the End of the Panic Stage

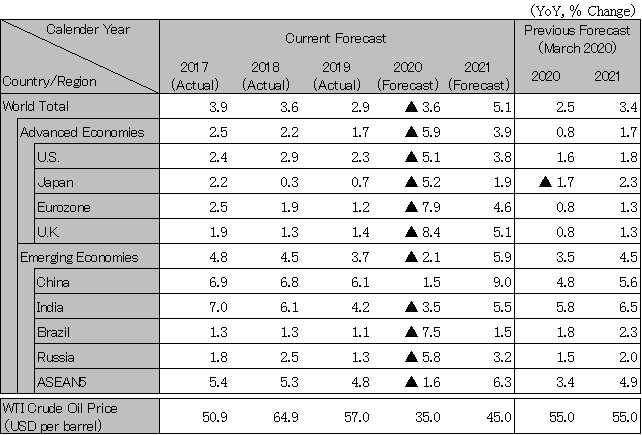

The center of the pandemic has shifted from Europe and the U.S. to emerging economies. The global economy is projected to shrink by 3.6% in 2020, a much bigger dip than in 2009 (-0.1%) immediately after the global financial crisis sparked by the Lehman Brothers collapse, and is heading for the worst postwar recession. Although monetary and financial policy responses to support economies may bring recovery in 2021, the rate of growth will be well below the trend level previously seen. Some emerging economies, as well as the U.S., have turned their focus to continuing their economic activities as a priority and lifting restrictions when the number of new infections has yet to show a downward trend. Should the second wave hit the world on a big scale, the global economy would face a double dip recession, with negative growth expected again in 2021. Moreover, there is potential for it to develop into a compound recession caused by other issues including the escalating tensions between the U.S. and China.

Prices of commercial paper (CP), corporate bonds and equities plunged after the novel coronavirus outbreak exploded in March 2020 as demand for liquidity and safe assets increased. The Federal Reserve has purchased CP and corporate bonds directly from banks and corporations to provide liquidity, helping to ease extreme disruption in the financial markets. However, the real economy deteriorated to the level of the Great Depression, as illustrated by the unemployment rate in April and May. With long-term Treasury yields firmly at low levels, it may take several years before the labor market recovers to the point where the Fed can end its zero-interest rate policy. While a phased reopening of the economy is expected to help its recovery, the pace of recovery could slow depending on the details of the fourth round of stimulus package to be enacted in July. There is also a risk of a deeper and longer recession if reopening too quickly contributes to a second wave of infections.

Thanks to a series of strict measures to fight the coronavirus, the outbreak has been brought under control, but they have also dramatically reduced economic activity. Even after reopening, one of the Eurozone’s core member states, Germany, is experiencing a sharp fall in capacity utilization, and new capital investment should remain weak for time being. Sluggish vehicle demand will also weigh heavily on growth in 2020. Italy and other southern European countries, which had relatively long lockdown periods and have high dependency on their service industries, may require even longer time to recover. If the European Commission fails to reach an agreement on a proposed (May 28) recovery fund consisting of loans and grants in the face of opposition from northern member states, the launch of the fund will be delayed and its effects diminished. Euro area GDP growth is projected to be -7.9% in 2020. Although the growth rate is expected to turn positive in 2021 at 4.6%, the recovery would be limited and only partially offset the decline.

Production and business activities have steadily resumed, as the outbreak has been brought under control. The National People’s Congress (NPC) decided to defer setting a growth target for 2020 on the one hand. However, it plans to push forward with measures to expand domestic demand through fiscal contributions including the construction of new infrastructure, such as 5G and datacenters, and renovation of aging residential accommodation, on the other. It also implemented financial support and tax relief measures to stabilize companies, and measures to increase consumption through securing jobs and incomes. Infrastructure investment should return to positive growth on a year-to-date cumulative basis in Q3 (July to September) 2020, followed by consumption, which is expected to turn positive slightly later in Q4 (October to December) 2020. In 2020, the economy is to decline by 2.0% in Q2 (April to June), but recover positive growth in Q3, reaching 1.5% growth for the year. The growth rate in 2021 is projected at 9.0%. The biggest uncertainty is sluggish overseas demand.

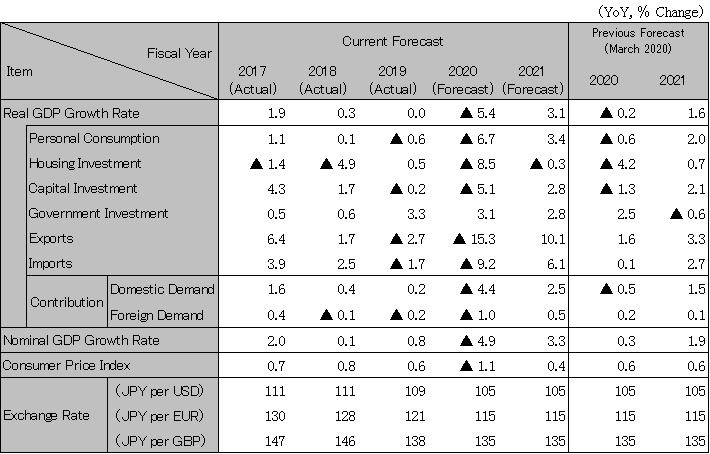

The economy entered a recession when it recorded negative growth for two consecutive quarters in Q4 2019 and Q1 (January to March) 2020 on the back of the consumption tax increase. Then it plunged further as commercial activities in the restaurant, accommodation, and education and entertainment industries shrank sharply in April and May following the declaration of a nationwide state of emergency. While economic activities should gradually head for recovery from July onward with the state of emergency being lifted, reopening comes with restrictions and the pace of recovery will be slow. Service consumption remains stagnant with voluntary restraint on activities amid concern over new infections. The government compiled a supplementary budget of 11% of GDP to support companies and individuals who fell into financial difficulty after the declaration of a state of emergency. This helped to avoid even further economic deterioration. Exports are also down mainly due to declines in sales of automobiles to the U.S. and machinery to China, curtailing production activity. Real GDP is to decline by 5.4% in Fiscal 2020, the largest fall since the current statistics were compiled in 1955, compared to 0.0% in Fiscal 2019. Growth is expected to return to positive territory but only modestly at 3.1% in Fiscal 2021.

Note: The figures above are calendar-year based. Accordingly, the figures of Japan are different from the fiscal-year based figures in the table below.

Source: IMF. Forecast by Hitachi Research Institute.

Source: Japan Cabinet Office, etc. Forecast by Hitachi Research Institute.

We provide you with the latest information on HRI‘s periodicals, such as our journal and economic forecasts, as well as reports, interviews, columns, and other information based on our research activities.

Hitachi Research Institute welcomes questions, consultations, and inquiries related to articles published in the "Hitachi Souken" Journal through our contact form.