Jan 28, 2021

Emerging hope for recovery in 2021 amid uncertainties

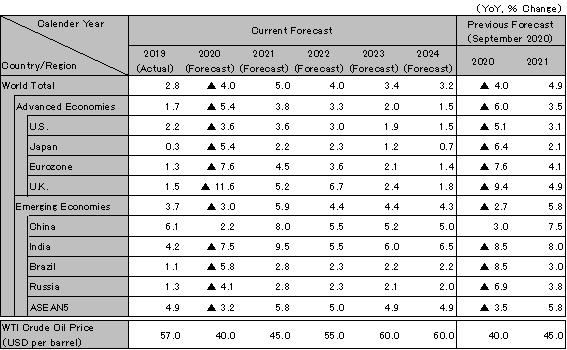

In 2020, while the U.S. avoided major confusion over the results of its presidential election, economic recovery was moderate due to the less dynamic measures caused by confrontation between political parties. The European economy marked negative growth again in the Oct–Dec quarter due to lockdowns in response to the resurgence in infections. China continues to recover, led by domestic demand. Development of multiple effective vaccines is progressing at a quick pace, and by the latter half of 2021, the vaccination rate is expected to be over 70% primarily in some developed countries. Global GDP growth rate is projected to recover to 5.0% in 2021 after plummeting to -4.0% in 2020. Differences in improvement levels among industries will remain for the time being. However, hope for a recovery is finally growing, particularly in developed countries, as we head toward the second half of 2021.

Although the U.S. economy recovered rapidly at a 33% annual rate quarter on quarter in Jul–Sep 2020, it slowed down from October onwards. This was due to the resurgence in infections and restrictions on business hours, among other factors. Consequently, recovery is expected to stagnate to 3.4% QoQ in Oct–Dec and to 0.0% QoQ in Jan–Mar 2021. By the end of 2020, incremental measures worth approximately 900 billion dollars, including an additional unemployment supplement, deferment of loan repayments, and promotion of vaccines, are planned to launch. In the Senate runoff elections in Georgia on January 5, Republicans are expected to block Democratic control of the Senate. The speed of recovery is projected to pick up in the latter half of 2021 with increased use of vaccines and consumption of surplus savings, but not enough to carry out infrastructure investments. A V-shaped recovery is unlikely, given growth projections of -3.6% in 2020 and 3.6% in 2021, and restoration to full employment is expected to take until mid-2023.

The eurozone recovered rapidly at a 61.1% annualized pace quarter on quarter in Jul–Sep 2020. However, negative growth is projected for Oct–Dec as many countries went into another lockdown in November following the resurgence in infections from October onwards. The manufacturing sector managed to get on a recovery path. But production and employment declined in the service industry, mainly in sectors involving the “three Cs” (closed spaces, crowded places, close-contact settings). The ECB strengthened its monetary easing by increasing the amount of asset purchases. Even southern European countries that have less fiscal room are supported by the EU recovery fund and continue to show fiscal expansion. The recovery is expected to pick up pace in the latter half of 2021 with the spread of vaccines. Growth projections for the eurozone are: -7.6% in 2020 and 4.5% in 2021. Avoiding the No-Deal Brexit scenario in late 2020, the UK is expected to show growth of -11.6% in 2020 and 5.2% in 2021.

The number of new infections in India has been on a downward trend after hitting the peak in mid-September. The countrywide lockdown, which has continued since March, is gradually being eased except in some areas. In October 2020, the government announced its first stimulus package since the spread of COVID-19 to create demand worth over 700 billion rupees (roughly over 1 trillion yen) and aimed at stimulating consumption and investment. On the other hand, prices continued to rise due to restrictions on distribution and other factors, hindering monetary easing. Growth is expected to be -7.5% in FY2020 and 9.5% in FY2021. Vietnam is the only ASEAN member country with solid performance. Malaysia is firming up, driven by exports of electrical and electronic equipment.

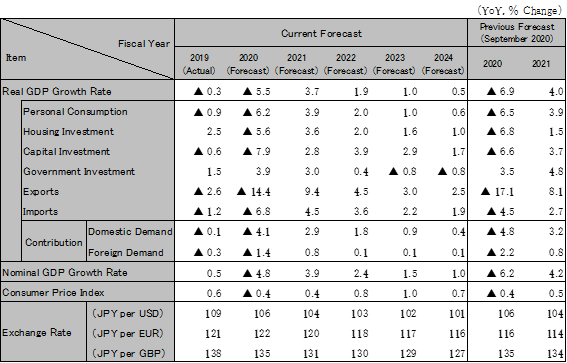

The Japanese economy grew at a 22.9% annual rate quarter on quarter in Jul–Sep 2020. Personal spending improved, encouraged by the government’s consumption stimulus measures. However, the recovery of consumption is expected to be weak going forward due to job insecurity and self-isolation caused by the resurgence of infections. The Suga administration has compiled an additional economic stimulus package worth a total of 74 trillion yen. This will support the economy in FY2021 by extending various benefits and consumption-driving measures and increasing public works toward building national resilience. It is expected that exports will recover, and production and investment will turn upward. A further recovery is likely in IT-related sectors, including semiconductor production equipment and devices, and the automotive sector. However, continuing stagnancy is projected in some service industries, such as retail, food service, hospitality, and public transportation. Real GDP is expected to be -5.5% in FY2020 and 3.7% in FY2021. Restoration of full employment is unlikely until FY2024.

Note: The figures above are calendar-year based. Accordingly, the figures of Japan are different from the fiscal-year based figures in the table below.

Source: IMF. Forecast by Hitachi Research Institute.

Source: Japan Cabinet Office, etc. Forecast by Hitachi Research Institute.

We provide you with the latest information on HRI‘s periodicals, such as our journal and economic forecasts, as well as reports, interviews, columns, and other information based on our research activities.

Hitachi Research Institute welcomes questions, consultations, and inquiries related to articles published in the "Hitachi Souken" Journal through our contact form.