May 3, 2021

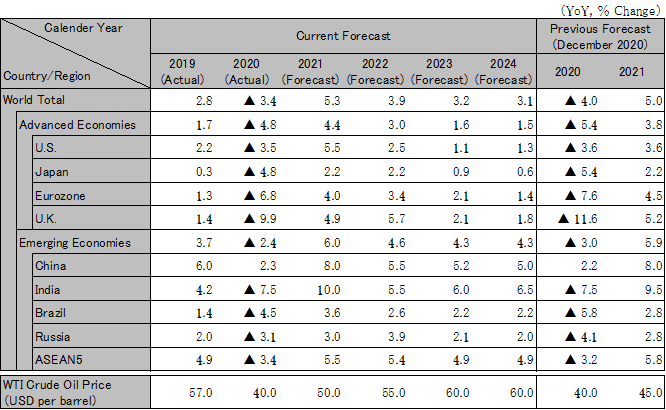

Despite a slow start to 2021, global economy to recover in the latter half, led by the U.S. and China

In 2021, the global economy will likely start off slow and be unstable from the beginning of the year to spring, due to the curtailment of activities caused by the resurgence in COVID infections from late 2020. It is expected to move on a recovery path from the latter half of 2021, driven by the effects of economic stimulus measures and the distribution of vaccines mainly in developed countries. China and the U.S. will likely lead the world’s overall economic recovery. The global economy marked negative growth of -3.4% in 2020, but is projected to grow 5.3% in 2021 and 3.9% in 2022. Uncertainties remain over the pace of vaccinations and the efficacy of vaccines. However, developed countries are expected to be the main drivers of support through fiscal expansion and monetary easing measures for the time being.

The European economy is expected to show negative growth in early 2021 due to stagnations in service industries caused by the resurgence in infections. However, lockdown measures will likely allow a certain level of economic activities, limiting the adverse impact on the economy as compared to 2020. In the second half of the year, the economy is expected to pick up its pace of recovery, backed by the spread of vaccines and the recovery funds. Moderate monetary easing measures will likely continue throughout the forecast period. Growth projections for the eurozone are 4.0% in 2021 and 3.4% in 2022. In the U.K., the post-Brexit confusion will likely have a limited adverse impact on the economy given the conclusion of an FTA with the EU. It is projected that vaccinations will progress relatively quickly, helping the economy to recover from the middle of 2021 onward. Real GDP growth rate forecasts for the U.K. are 4.9% in 2021 and 5.7% in 2022.

The year 2021 is an important one ahead of the National Congress of the Chinese Communist Party scheduled for 2022. The government is seeking to underpin domestic demand by promoting domestic investments, including new types of infrastructure projects. At the same time, it will pay close attention to curbing the resurgence in infections in an aim to improve employment income and recover consumption. Based on this policy, the economy is expected to show high growth of around 8%. There will likely be continued vigilance against the risk of destabilization of the financial system potentially caused by a sharp decline in the real estate market and a chain reaction collapse of companies among other factors. In 2022, the economy is expected to make a soft landing, with a growth rate in the mid-5% range, which is believed to be cruising speed. In anticipation of a drawn-out struggle assuming a protracted conflict with the U.S., China has set out its dual circulation strategy to boost domestic demand and strengthen investment and trade relations with countries other than the U.S.

In India, economic activities have been recovering steadily since the autumn of 2020 as a result of a phased easing of lockdown measures following a decline in new infections. In FY2021, the economy is expected to show high growth at a rate of 10.0% in reaction to the slump in FY2020 and driven by fiscal stimulus measures. It will be some time before the problem of non-performing loans is completely resolved. The five ASEAN member countries are expected to be on a recovery path on the whole in 2021, but differences in their resilience will remain. Vietnam will likely maintain economic strength while Malaysia moves toward recovery, supported by growth in exports of electrical and electronic products. On the other hand, Thailand, which is highly dependent on tourism, will presumably remain unstable in 2021 due in part also to political concerns, including anti-government demonstrations.

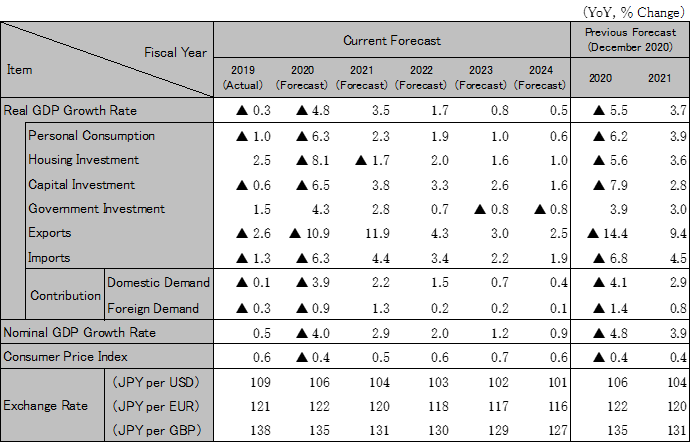

In the October-December quarter of 2020, the Japanese economy marked a recovery of 12.7% QoQ. However, negative growth is expected in the January-March quarter of 2021 due to a slump in consumption as the government declared another state of emergency in conjunction with a resurgence in infections. From spring onward, the economy will likely recover, backed by an increase in public work projects and measures to support consumption based on the third supplementary budget (19.2 trillion yen) passed in late January. Given recoveries in overseas economies, growth in exports will also likely contribute to restoring the economy. It is projected that vaccines will be available to the majority of people wishing to get vaccinated in the second half of FY2021. The economic recovery is expected to pick up pace as business conditions significantly improve in the service sectors (e.g. food and beverage services, lodging, entertainment, retail and public transportation) that have been sluggish due to the difficulty in avoiding the 3Cs (closed spaces, crowded places, close-contact settings). Real GDP growth rate is projected to be 3.5% in FY2021 and 1.7% in FY2022. A full recovery in employment is expected in the second half of FY2023.

Note: The figures above are calendar-year based. Accordingly, the figures of Japan are different from the fiscal-year based figures in the table below.

Source: IMF. Forecast by Hitachi Research Institute.

Source: Japan Cabinet Office, etc. Forecast by Hitachi Research Institute.

We provide you with the latest information on HRI‘s periodicals, such as our journal and economic forecasts, as well as reports, interviews, columns, and other information based on our research activities.

Hitachi Research Institute welcomes questions, consultations, and inquiries related to articles published in the "Hitachi Souken" Journal through our contact form.