Oct 3, 2023

Remaining risks of both economic downturn and renewed inflation, no stable recovery until late 2024

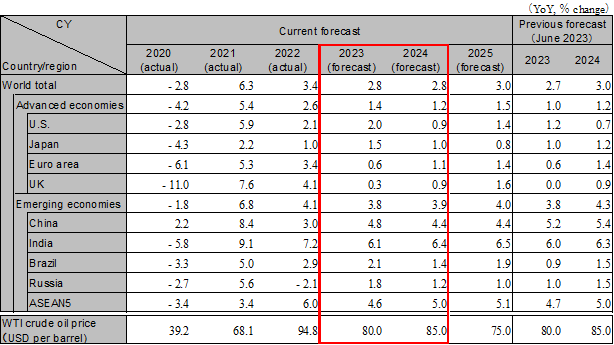

While the U.S. economy has remained firm, concerns about a prolonged slump in China have increased. China’s current stagnation is considered to be due in part to structural problems and insufficient policy responses, and requires close monitoring. In the U.S., credit concerns over financial institutions remain, although they have eased somewhat. The global inflation and monetary tightening cycle appears to have peaked, but the risk of a resurgence of inflation due to renewed price hikes in oil, food, and other commodities also warrants attention. Lacking a clear driver, the global economy is expected to stall until the first half of 2024, with recovery expected in the second half of 2024. GDP growth of 2.8% is forecast for both 2023 and 2024, with risks to the downside.

In the first half of 2023, the U.S. economy remained firm, supported by strong consumer spending, and the second half of 2023 is expected to see another strong start in consumption, with the U.S. economy reaching high growth for the full year. On the other hand, the U.S. economy will decelerate gradually through the first half of 2024 mainly due to the Fed’s continued interest rate hikes. The labor supply and demand situation will gradually ease, and inflation is expected to decline. Financial instability has eased, but the situation remains cautious. The Fed is expected to start cutting interest rates in March 2024. Real GDP growth is expected to be 2.0% in 2023 and 0.9% in 2024.

In the first half of 2023, the Euro area economy continued to grow at a low rate. In Germany, in addition to weak purchasing power due to inflation, production has been sluggish due to multiple factors, including the slowdown of the Chinese economy. The deterioration in business confidence is spreading to the service sector as well. In the midst of the economic slowdown, the ECB raised the central bank deposit rate to 4%, and we expect it will leave it unchanged. We expect core inflation to slow down and the economy to gradually recover through 2024. The UK economy maintained positive growth in the first half of 2023, but high inflation weighed on the economy. The UK will remain on a low-growth path through the second half of the year. Real GDP growth in the Euro area is forecast to be 0.6% in 2023 and 1.1% in 2024. Real GDP growth in the UK is forecast at 0.3% in 2023 and 0.9% in 2024.

In China, the economy is slowing as the real estate market continues to stagnate and developers’ cash flow has been deteriorating. The government is introducing a series of measures to support the economy, although they are only incremental measures. It will take time for demand to recover and inventories to shrink. With concerns about a decline in real estate values and employment uncertainty especially among the young, households are becoming saving-oriented, and the recovery in consumption will remain gradual. We assume that real estate and consumption will recover in the second half of 2024. As exports remain weak and foreign direct investment declines sharply, the country cannot rely on external demand. Growth is expected to decline over the medium term amid stagnant prices, rising debt and a declining labor force. Real GDP growth is projected to be 4.8% in 2023 and 4.4% in 2024.

India is expected to continue to grow steadily on the back of increased infrastructure investment and other factors. Business sentiment both in the manufacturing and service sectors is also favorable. Core inflation has returned to the inflation target range, and the Reserve Bank of India has suspended interest rate hikes since April. However, food prices, such as rice, have been rising recently, and caution is needed to avoid a resurgence of inflation. Growth is projected at 6.1% in FY2023 and 6.4% in FY2024. ASEAN generally continues to recover, but the pace of growth is gradually slowing. As in India, attention should be paid to a resurgence of inflation. Growth is projected at 4.6% in 2023 and 5.0% in 2024.

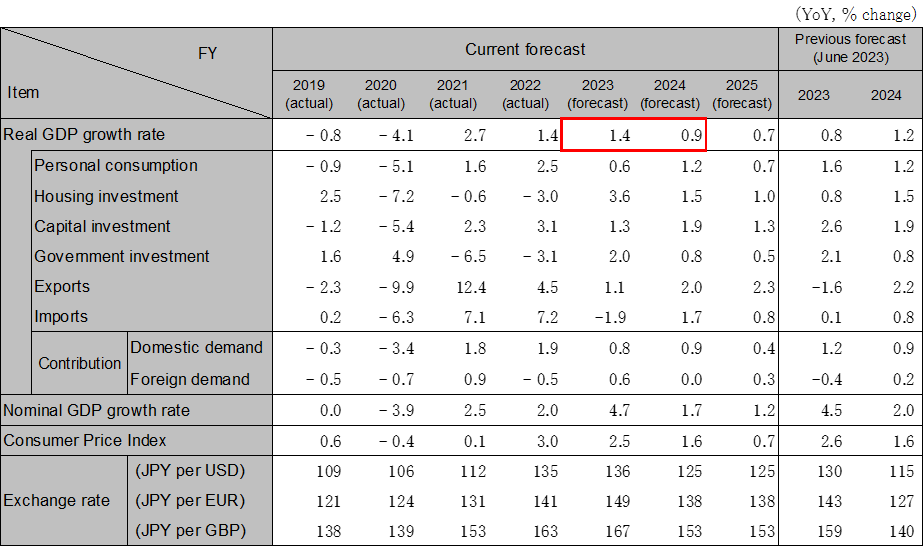

While some weakness in consumption can be seen, consumption has generally approached the pre-COVID level. Going forward, consumption is expected to continue recovering moderately on the back of an increase in service consumption with a recovery in the influx of people. The BOJ may effectively abolish yield curve control or may proceed to lift negative interest rates in March 2024 at the earliest. Despite the high level of planned capital investment, the current situation is somewhat weak. While exports have started to recover moderately, the global economic slowdown is a downside risk factor. Real GDP growth is expected to be 1.4% in FY2023 (1.5% in CY2023) and 0.9% in FY2024 (1.0% in CY2024).

Note:Values for Japan differ from those shown in the table below on a fiscal-year basis because they are on a calendar-year basis. However, India’s figures are shown on a fiscal-year basis. ASEAN5 is comprised of Indonesia, Thailand, Malaysia, the Philippines, and Vietnam.

Source: IMF, forecasts by Hitachi Research Institute

Note: The individual numbers and their sum may not match due to fractional processing.

Source: Cabinet Office, forecasts by Hitachi Research Institute

We provide you with the latest information on HRI‘s periodicals, such as our journal and economic forecasts, as well as reports, interviews, columns, and other information based on our research activities.

Hitachi Research Institute welcomes questions, consultations, and inquiries related to articles published in the "Hitachi Souken" Journal through our contact form.