Mar 13, 2024

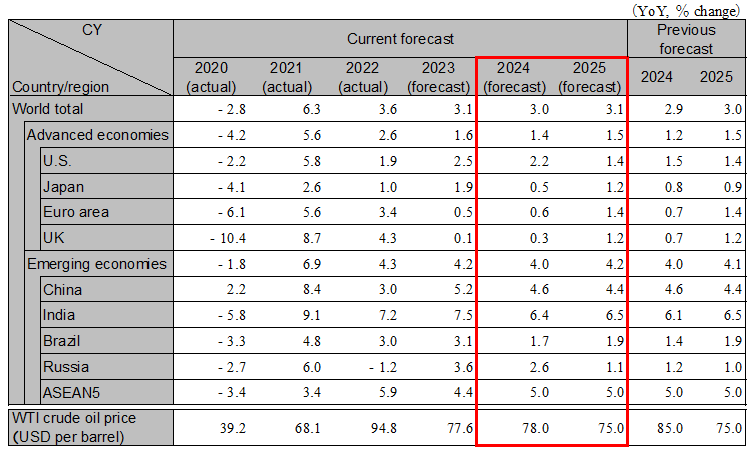

The outlook for the global economy continues to be highly uncertain due to geopolitical turmoil in the Middle East and Ukraine, turbulence in international politics during election years such as the U.S. presidential election, renewed inflation, prolonged stagnation in the Chinese economy, the risk of a financial crisis originating in the United States, and other factors. Accordingly, "fragile stability" is expected to continue in 2024. However, if the world economy gets through 2024 without turbulence, the possibility of growth prospects for 2025 and beyond will increase. There will also be increased business opportunities, such as the development of technological innovations, including generative AI, support for semiconductor investment in various countries, reconstruction financing, and increased defense-related spending. Global growth is projected at 3.0% in 2024 and 3.1% in 2025.

In 2023, the U.S. economy grew by 2.5%, supported by strong domestic demand such as consumer spending, etc. In 2024, the economy starts off strong, especially in terms of domestic demand, including employment. However, it is expected to slow down towards mid-2024, given the decline in new job openings and slowing investment due to higher interest rates. On the other hand, underlying inflation is forecasted to decline, and the Fed is expected to start cutting interest rates in June 2024, which will help the U.S. economy recover from the second half of the year and achieve growth in the low 2% range for the full year. However, the risk of financial instability stemming from factors such as defaults on commercial real estate loans will remain. Real GDP is expected to grow at 2.2% in 2024 and 1.4% in 2025.

In the second half of 2023, the growth rate of the euro area economy was low at 0.5%, with Germany and France experiencing negative growth for the second consecutive quarter. 2024 has gotten off to a slow start, but inflationary pressures are clearly easing. From mid-2024, the economy is expected to recover as purchasing power recovers due to slower inflation and the Chinese economy stabilizes. We expect the ECB to proceed with interest rate cuts beginning in June 2024. In the U.K., the economy is forecasted to bottom out and begin to recover in 2024, as business confidence in both the manufacturing and service sectors improves with price stability. Real GDP growth in the euro area is expected to grow at 0.6% in 2024 and 1.4% in 2025. Real GDP growth in the UK is expected to grow at 0.3% in 2024 and 1.2% in 2025.

China's fiscal stimulus of 1 trillion RMB is expected to take effect from spring 2024, mainly in flood control infrastructure construction, supporting the economy. Exports are also expected to pick up in the second half of 2024. On the other hand, the normalization of the real estate market will be delayed until early 2025 due to a delay in inventory adjustments and the delivery of uncompleted properties. Consumption is expected to recover slowly until the end of 2024 due to sluggish real estate prices and youth unemployment. The PBoC will continue monetary easing, but the effects are expected to be limited amid rising deflationary pressures, such as sluggish prices and insufficient demand due to the shrinking population. Growth will slow after the effects of the fiscal stimulus measures wear off. Real GDP growth is expected to be 4.6% in 2024 and 4.4% in 2025.

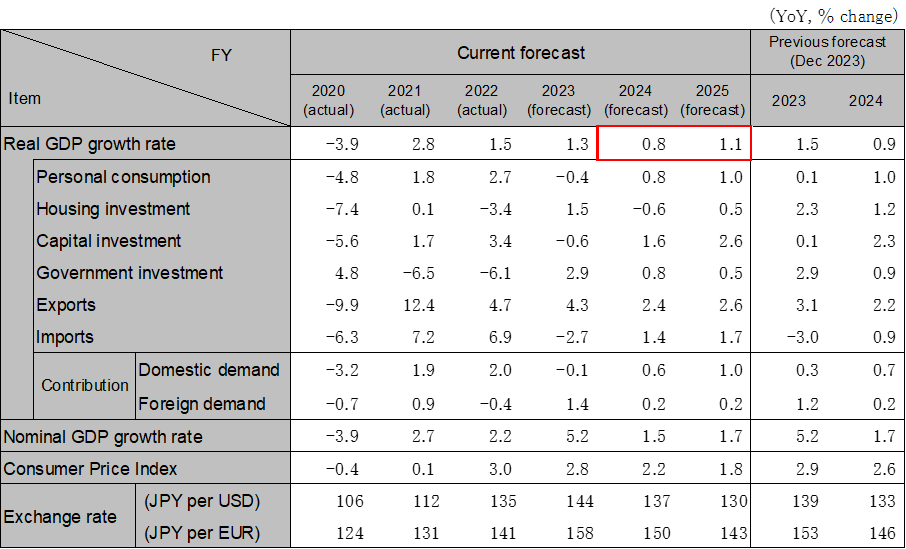

In FY2024, the Japanese economy will continue to recover moderately, due in part to increased consumption and capital investment, reflecting a recovery in real wages. With strong prospects for favorable spring labor agreement results, the BOJ is expected to proceed with lifting negative interest rates in the spring of 2024. We expect capital investment plans to remain at aggressive, and we anticipate an increase in capital investment, backed by high recurring profits and intense labor and equipment shortages. Exports are currently steady, especially to the U.S. The economy will continue to recover moderately, with growth projected at 0.8% in FY2024 (0.5% in calendar year 2024) and 1.1% in FY2025 (1.2% in calendar year 2025).

India is expected to continue to grow steadily, supported by firm domestic demand, including infrastructure investment and consumption. Inflation is generally within the target range and interest rate hikes have already been suspended; accordingly, downside risks to the economy are limited. Growth is forecast to be 7.5% in FY2023, 6.4% in FY2024 and 6.5% in FY2025. The ASEAN economies are also expected to continue to recover in general. While caution is needed with regard to the impact of the economic slowdown in China and other factors, exports are expected to gradually bottom out and inbound demand will continue to pick up. The growth rate is forecast to be 5.0% in both 2024 and 2025.

Note:Values for Japan differ from those shown in the table below on a fiscal-year basis because they are on a calendar-year basis. However, India’s figures are shown on a fiscal-year basis. ASEAN5 is comprised of Indonesia, Thailand, Malaysia, the Philippines, and Vietnam.

Source: IMF, forecasts by Hitachi Research Institute

Note:The individual numbers and their sum may not match due to fractional processing.

Source: Cabinet Office, forecasts by Hitachi Research Institute

We provide you with the latest information on HRI‘s periodicals, such as our journal and economic forecasts, as well as reports, interviews, columns, and other information based on our research activities.

Hitachi Research Institute welcomes questions, consultations, and inquiries related to articles published in the "Hitachi Souken" Journal through our contact form.