Oct 2, 2024

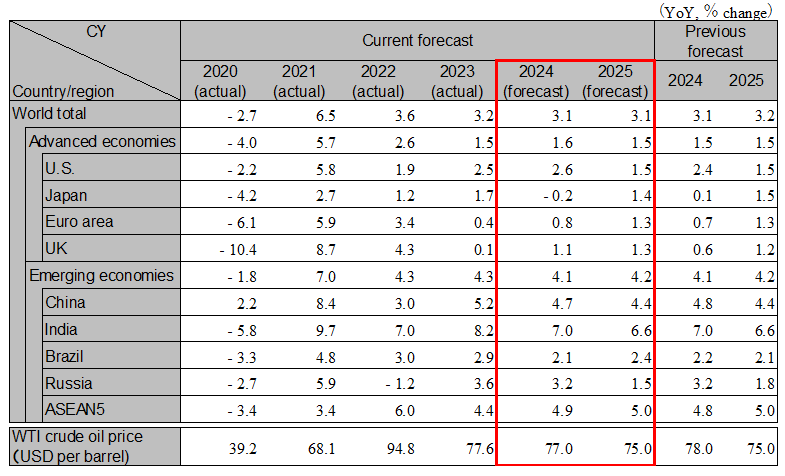

Since the summer of 2024, global financial markets have been unstable, mainly due to rising concerns about the U.S. economic outlook. With the Chinese economy continuing to stagnate, the global economy as a whole is at a standstill. From now through the first half of 2025, the global economy as a whole is expected to lack momentum due to the slowdown in the U.S. and stagnation in China. Thereafter, the global economy is expected to recover in the second half of 2025, leveraged by a U.S. economic recovery due to interest rate cuts and so on. The global growth rate will be 3.1% in both 2024 and 2025. Caution is needed regarding the unexpectedly rapid deterioration of the U.S. economy, market turmoil surrounding the presidential election, and the policies of the new U.S. administration.

The U.S. economy continues to show solid growth. However, a slowdown in job growth and worsening conditions in the manufacturing sector due to cumulative interest rate hikes are expected to lead to an economic deceleration from late 2024 to early 2025. The Fed decided on a 0.5% rate cut at the September FOMC meeting, and it is anticipated that they will continue to gradually lower rates after October 2024, while monitoring economic indicators. As a result of the Fed's rate cuts, the U.S. economy is expected to begin recovering in the second half of 2025. However, if the demand stimulus from expansionary fiscal policies after the presidential election leads to a resurgence of inflation and a rise in interest rates, this could pose economic risks in 2025. The real GDP growth rate is forecast to be 2.6% in 2024 and 1.5% in 2025.

The euro area economy is continuing its gradual recovery, with a real GDP growth rate of +0.8% year-on-year in the April to June period. By country, Spain is experiencing strong growth, while Germany is facing negative growth. In response to declining inflation, the ECB implemented an additional rate cut in September. As a result of these rate cuts and the slowing inflation, the euro area economy is expected to achieve a growth rate in the low 1% range in 2025. The UK is also projected to have growth in the low 1% range in 2025, but attention should be paid to the impact of the Labour Party's austerity measures. Real GDP growth in the euro area is forecast to be 0.8% in 2024 and 1.3% in 2025. Real GDP growth in the UK is projected to be 1.1% in 2024 and 1.3% in 2025.

In China, domestic demand is weakening. Export growth continues due to price cuts in steel, automobiles, etc., but growth will be slow toward 2025 due to additional tariffs in the U.S. and Europe, which are concerned about the overproduction problem. Infrastructure investment and manufacturing investment will drive growth due to fiscal stimulus, while real estate investment will continue to decline due to insufficient government measures to adjust inventories. Consumer confidence is weak, and consumption growth will continue to be limited due to declining real estate prices and stagnant employment. Structural problems, such as the buildup of local debt due to a decline in land ownership transfer income, price stagnation, and a declining labor force, will put downward pressure on growth in 2025. Real GDP growth will be 4.7% in 2024 and 4.4% in 2025.

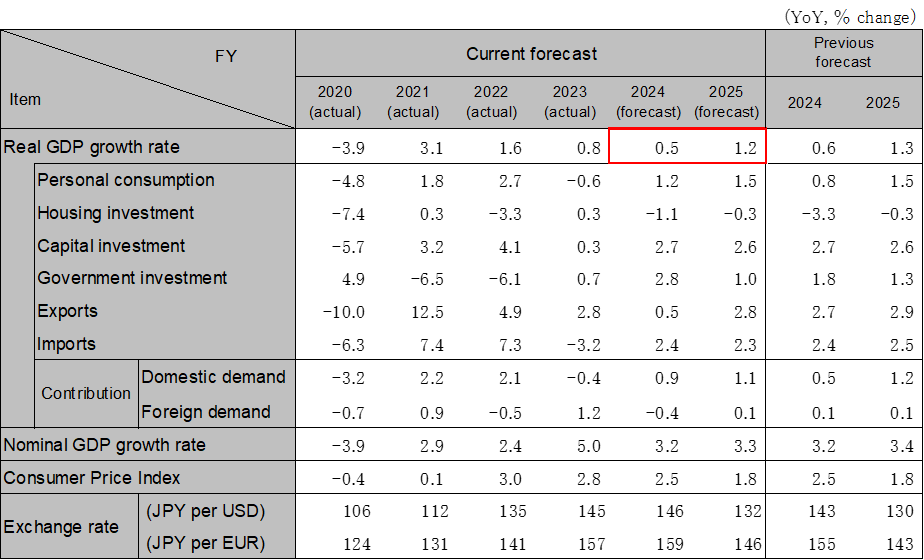

The Japanese economy is expected to continue to recover moderately in 2025 due to an improvement in consumer sentiment resulting from easing of price pressures and a rebound in consumption accompanying a recovery in real wages on the back of favorable annual labor agreement results. Capital investment is expected to increase on the back of recovering exports, high level of current profits of large companies, and improving profit trends of small companies. Exports are expected to recover from the second half of 2025, due in part to global demand for semiconductors and a recovery in demand following interest rate cuts in the U.S. and Europe. Thereafter, the BOJ is expected to raise interest rates by 0.25% each in 2024 and 2025. Real GDP growth is forecast to be -0.2% in 2024 (0.5% for FY) and 1.4% in 2025 (1.2% for FY).

India's economy continues to be strong, especially in consumption and investment, as inflation stabilizes. Business and consumer sentiment is also favorable. High growth is expected to continue in the future on the back of firm domestic demand, including infrastructure investment and consumption. With slowing inflation, India’s monetary policy may see it cut interest rates early in FY2025. The growth rate is forecast to be 7.0% in FY2024 and 6.6% in FY2025. ASEAN5 has generally seen a recovery in exports and tourism demand, and inflation has calmed down, although there are variations from country to country. ASEAN5 growth rates are projected to be 4.9% in 2024 and 5.0% in 2025.

Note: Values for Japan differ from those shown in the table below on a fiscal-year basis because they are on a calendar-year basis. However, India’s figures are shown on a fiscal-year basis. ASEAN5 is comprised of Indonesia, Thailand, Malaysia, the Philippines, and Vietnam.

Source: IMF, forecasts by Hitachi Research Institute

Note: The individual numbers and their sum may not match due to fractional processing.

Source: Cabinet Office, forecasts by Hitachi Research Institute

We provide you with the latest information on HRI‘s periodicals, such as our journal and economic forecasts, as well as reports, interviews, columns, and other information based on our research activities.

Hitachi Research Institute welcomes questions, consultations, and inquiries related to articles published in the "Hitachi Souken" Journal through our contact form.