Dec 10, 2024

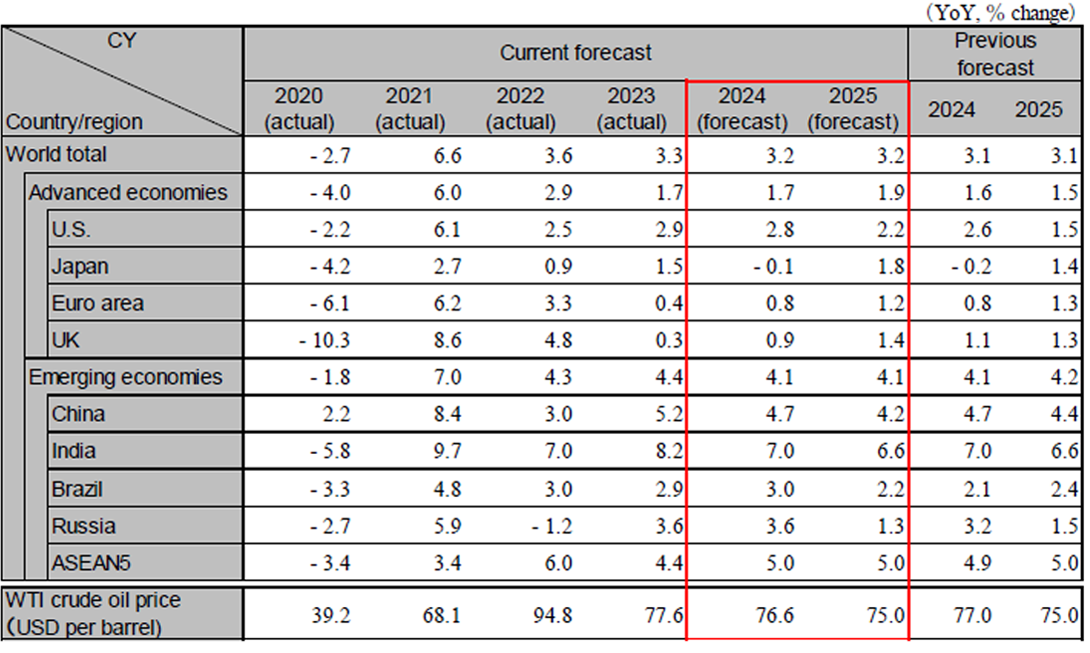

The global economy in 2025 is likely to be a year of heightened uncertainty and marked differences in business conditions due to the impact of policy changes in various regions, centered on the U.S.. Specifically, the U.S. and India are expected to continue to perform strongly, ASEAN countries are expected to maintain stable growth overall, and Japan is expected to recover gradually, while Europe and China are expected to experience relatively weak economic conditions. Escalating trade wars, a deepening slowdown in the Chinese economy, and rising geopolitical tensions are the main risks to the global economy in 2025. The global real GDP growth rate will be 3.2% in both 2024 and 2025.

The U.S. economy continues to show resilient growth. The economic policies of the Trump administration, through expectations of tax cuts and deregulation, are expected to boost the U.S. economy through 2025 via rising stock prices. While tariff increases are expected to dampen the economy, considering the lag in their impact on inflation and consumption, the effects are likely to be felt in the latter half of 2025. Through 2025, the Fed is expected to proceed cautiously with interest rate cuts, while assessing the impact of the new administration's policies on inflation. The risk for 2025 is a scenario where rapid and widespread tariff hikes cause soaring interest rates and a sharp decline in stock prices. The real GDP growth rate is expected to be 2.8% in 2024 and 2.2% in 2025.

The euro area economy is experiencing an increasing sense of economic slowdown. The deterioration in business sentiment is spreading not only in the manufacturing sector but also in the services sector. If President Trump imposes tariffs on exports, it would hurt economies such as Germany and Italy, which have large trade surpluses with the U.S., but the extent of the impact will depend on the timing and the tax rates. Against the backdrop of the economic slowdown, the ECB is expected to accelerate interest rate cuts through 2025. In the UK, the Labour Party's expansionary fiscal policies and the BOE's gradual interest rate cuts are expected to support the economy in 2025. The real GDP growth rate for the euro area is projected to be 0.8% in 2024 and 1.2% in 2025. For the UK, the real GDP growth rate is expected to be 0.9% in 2024 and 1.4% in 2025.

The Chinese government has implemented stimulus measures such as monetary easing and debt restructuring, but the effects are limited. Structural problems such as a decline in the labor force and an increase in local government debt will put downward pressure on the economy. Real estate sales have declined due to falling prices and concerns about completion, and inventory adjustments are expected to be prolonged. Although the effects of measures to promote replacement purchases have emerged, consumer sentiment remains sluggish. The Trump administration is assumed to impose an additional 10% tariff from the beginning of 2025. Europe and ASEAN will also impose tariffs, fearing the impact on their domestic industries. The government will provide support for manufacturing and infrastructure investment to mitigate the impact, but the growth rate will decline due to a slowdown in exports. The real GDP growth rate is expected to be 4.7% in 2024 and 4.2% in 2025.

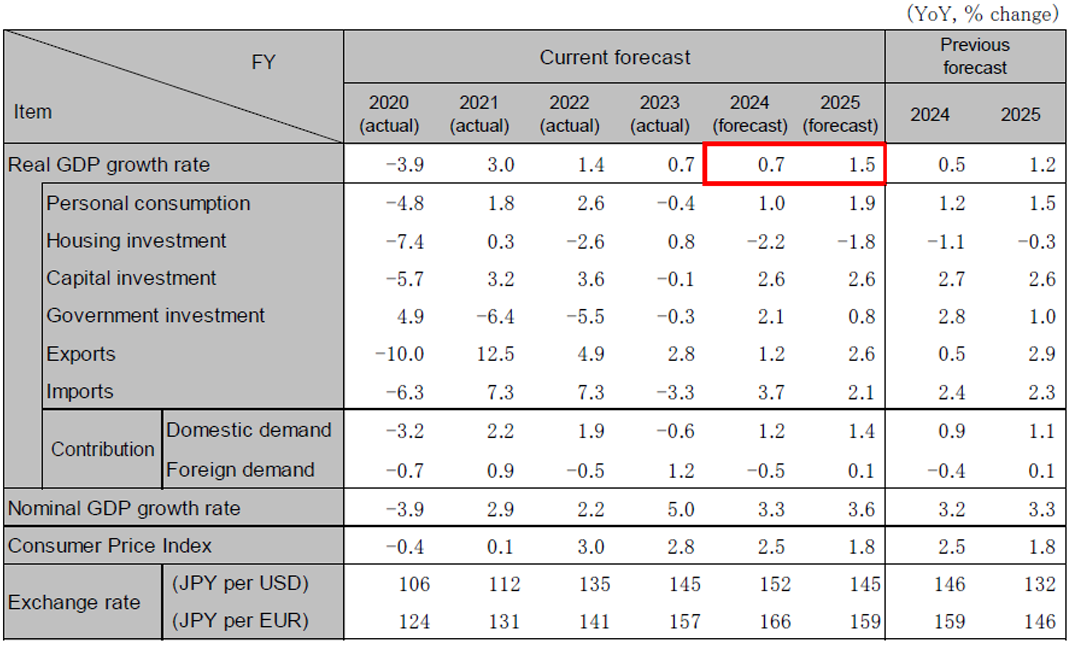

In 2025, the Japanese economy is expected to recover moderately, backed by strong inbound demand and a recovery in consumption on the back of the annual wage talks. Capital investment is expected to continue to increase, especially among large companies, although caution must be exercised in the face of growing uncertainty, such as the Bank of Japan's early interest rate hike. Exports would recover basically, although there are concerns that tariffs will exert downward pressure on exports of transportation equipment and machinery, which have large surpluses with the US. Thereafter, the BOJ will raise interest rates by 0.25% each in 2024 and 2025. Real GDP growth is expected to be -0.3% in CY 2024 (0.4% for FY) and 1.5% in CY 2025 (1.4% for FY).

India continues to experience steady growth. Although there has been a rise in food prices recently, inflation is generally stable, and a cut in interest rates is on the horizon. With business and consumer sentiment favorable, high growth is expected to continue against the backdrop of strong domestic demand. The real GDP growth rate will be 7.0% in FY2024 and 6.6% in FY2025. The ASEAN5 also will continue to experience stable growth, with exports and tourism demand recovering in general. But some countries with a surplus with the U.S., such as Vietnam, will need to be careful about Trump's trade policy. The Real GDP growth rate for the ASEAN5 will be 5.0% in both 2024 and 2025.

Note: Values for Japan differ from those shown in the table below on a fiscal-year basis because they are on a calendar-year basis. However, India’s figures are shown on a fiscal-year basis. ASEAN5 is comprised of Indonesia, Thailand, Malaysia, the Philippines, and Vietnam.

Source: IMF, forecasts by Hitachi Research Institute

Note: The individual numbers and their sum may not match due to fractional processing.

Source: Cabinet Office, forecasts by Hitachi Research Institute

We provide you with the latest information on HRI‘s periodicals, such as our journal and economic forecasts, as well as reports, interviews, columns, and other information based on our research activities.

Hitachi Research Institute welcomes questions, consultations, and inquiries related to articles published in the "Hitachi Souken" Journal through our contact form.