Sep. 25, 2025

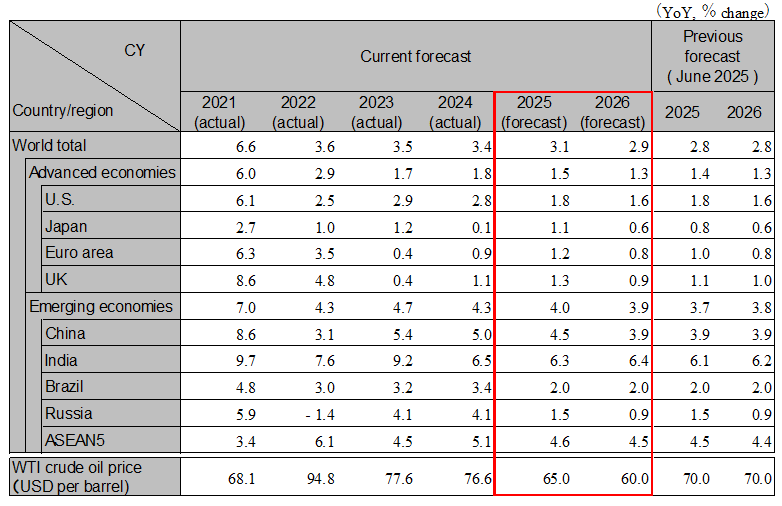

The situation surrounding Trump's tariffs remains uncertain in some areas, such as the status of countries continuing negotiations and the treatment of specific products. However, agreements have been reached with many countries, and with the exception of a few, tariff rates have decreased, leading to a slight easing of tensions. While certain impacts will become apparent going forward, concerns about their magnitude have eased somewhat. In various countries, with inflation stabilizing, short-term economic boost effects from monetary and fiscal policy responses designed to support the economy are also anticipated. On the delicate balance between tariff impacts and policy responses, the outlook is for barely maintaining 3% growth in 2025. Caution is needed regarding risks originating in the U.S., such as inflation and worsening employment conditions stemming from interest rate cuts and tariffs. Global real GDP growth is projected at 3.1% in 2025 and 2.9% in 2026.

The U.S. economy is showing increasing signs of slowing, primarily driven by personal consumption. August's non-farm payrolls increased by 22,000 from the previous month, clearly indicating a deceleration in job growth, accompanied by a rise in layoffs. Inflation rates continue to exceed 2%, but the FRB, which resumed rate cuts citing slowing employment, is expected to implement further additional rate cuts within 2025. The Trump administration is actively promoting investment from foreign countries and domestic companies, and capital investment is likely to remain resilient. However, amid continued slowing in personal consumption, the U.S. economy is expected to decelerate in 2025 and 2026. The U.S. real GDP growth rate is projected to be 1.8% in 2025 and 1.6% in 2026.

The euro area economy shows signs of improving sentiment from mid-2025 onward. This appears to be driven by factors such as tariff negotiation agreements, falling oil prices, and expectations for increased government spending. Through 2026, the euro area economy is expected to continue its gradual recovery, driven by increased defense spending and expanded infrastructure investment. The ECB is forecasted to maintain its policy interest rate at the 2% level. In the UK, despite continued sluggish consumption, the BOE is expected to continue cutting interest rates at a cautious pace as inflation shows signs of rising. Real GDP growth in the euro area is projected at 1.2% in 2025 and 0.8% in 2026. Real GDP growth in the UK is projected at 1.3% in 2025 and 0.9% in 2026.

China's economy has grown steadily, driven by consumption, but sentiment remains weak, particularly in the manufacturing sector. Exports to Asia are increasing, while those to the U. S. are sharply declining, indicating a slowdown. Due to declining sales prices caused by intensifying domestic competition, profit margins in manufacturing industries such as automobiles are trending downward, so the growth rate of manufacturing investment is likely to slow. Consumption is expected to continue benefiting from government stimulus measures, but significant future growth is unlikely given sluggish disposable income growth and declining asset prices due to the real estate slump. The Chinese government will continue its fiscal expansion policy, but the growth rate will slow. China's real GDP growth rate is projected to be 4.5% in 2025 and 3.9% in 2026.

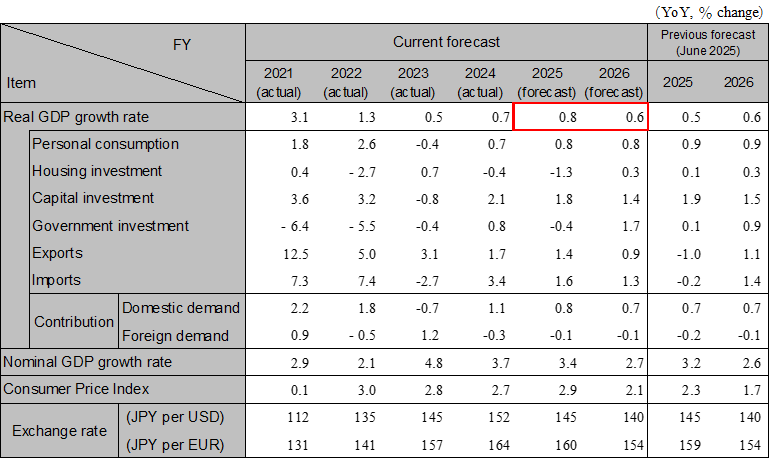

The Japanese economy is expected to continue its recovery trend, as domestic demand remains resilient despite a projected slowdown in exports due to U.S. tariffs and other factors. Following the spring wage negotiations, real wages are expected to turn positive going forward, leading to a gradual recovery in consumption. Capital investment is expected to remain resilient, supported by high profit margins and a sense of equipment shortages, particularly in the non-manufacturing sector, despite the impact of the overseas slowdown. Public investment will be subdued in 2025 as it marks the final year of the National Resilience Initiative, while housing investment will see a reactionary decline due to the mandatory implementation of energy efficiency standards and the last-minute demand in the previous year. The BOJ is expected to raise interest rates again within 2025. Japan's real GDP growth rate is projected to be 1.1% in 2025 (FY 0.8%) and 0.6% in 2026 (FY 0.6%).

India faces a 50% tariff imposed by the U.S., but its export dependency is low. It is expected to be able to absorb the tariff impact through measures such as stimulating consumption via the review of the Goods and Services Tax (GST). India's real GDP growth rate is projected to be 6.3% in fiscal year 2025 and 6.4% in fiscal year 2026, driven by the service sector. ASEAN-5 countries are expected to maintain stable growth in the 4% range overall, though political and economic conditions vary by country. Differences may also arise in the impact of tariffs, the U.S.-China economic slowdown, and the expansion of China's excess supply. It is necessary to closely monitor country-specific risks, such as household debt problems in Thailand and South Korea, and political instability in Indonesia. The ASEAN-5's real GDP growth rate is projected at 4.6% in 2025 and 4.5% in 2026.

Note: Values for Japan differ from those shown in the table below on a fiscal-year basis because they are on a calendar-year basis. India’s figures are shown on a fiscal-year basis. ASEAN5 is comprised of Indonesia, Thailand, Malaysia, the Philippines, and Vietnam.

Source: Actual figures are from the IMF, forecasts are from the IMF (Brazil and Russia), and Hitachi Research Institute (others)

Note: The individual numbers and their sum may not match due to fractional processing.

Source: Cabinet Office, forecasts by Hitachi Research Institute

We provide you with the latest information on HRI‘s periodicals, such as our journal and economic forecasts, as well as reports, interviews, columns, and other information based on our research activities.

Hitachi Research Institute welcomes questions, consultations, and inquiries related to articles published in the "Hitachi Souken" Journal through our contact form.