Feb. 10, 2026

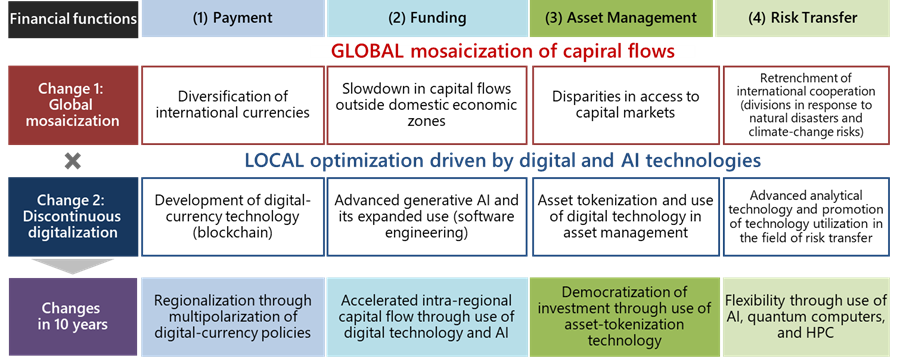

The global economic trend is shifting from globalization towards a kind of “global mosaicization” in which the economic zone of each country and region is pursuing its own path in a manner that is fragmenting the global movement of people, goods, money, and data. Furthermore, dramatic advances in innovative technologies, such as generative artificial intelligence (AI), are driving “discontinuous digitalization” and ushering in an era of fundamental change in society. This report looks ahead to the state of finance in ten years by predicting the impact and new value that these two changes—global mosaicization and discontinuous digitalization—will bring to financial functions such as payment, funding, asset management, and risk transfer.

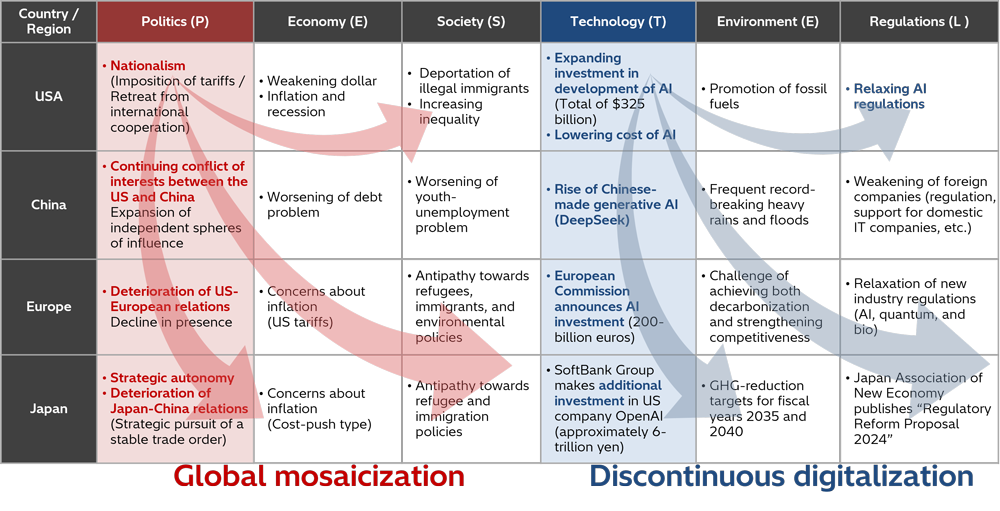

When looking at finance ten years from now, we consider the changes in the global macro environment that will serve as the starting point. To paint a picture of the future of finance, it is the first essential to recognize the environment in terms of the current international situation and technological advances. When Hitachi Research Institute (HRI) conducted a PESTEL analysis, we uncovered two changes that will impact finance in ten years (Figure 1).

The first change is the "mosaicization of the world." This term refers to the fragmentation of the global movement of people, goods, money, and data caused by factors such as the rise of nationalism and populism in the United States (US), and this fragmentation has led to the breakdown of the international cooperation system that previously brought a sense of global unity. Specific examples include a backlash against immigration in the United States, Europe, and Japan, a slowdown in global imports and exports of goods due to US tariff policies, and stricter data-transfer regulations enforced in China.

The second change is "discontinuous digitalization." Investment in AI development has reached $325 billion in the United States*1, and generative AI is rapidly becoming more powerful and cheaper. In China, the rise of domestically developed generative AI, such as DeepSeek, continues. Meanwhile, Europe is investing 200 billion euros in AI*2, and in Japan, the SoftBank Group is expected to invest up to 6 trillion yen in OpenAI. These large-scale investments in AI-driven technological innovation are expected to bring about discontinuous changes that will shake the very foundations of society.

Figure 1: PESTEL analysis of major global countries

The two aforementioned changes—global mosaicization and discontinuous digitalization—will bring about a major transformation in finance, which has previously been oriented towards internationalization and market integration. Rather than extrapolating present circumstances, in this report, we predict the future of finance based on these two changes.

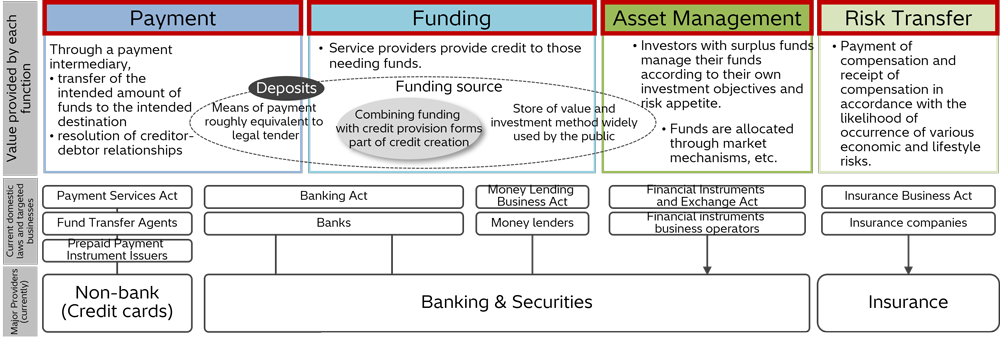

In this report, while classifying financial functions into four types, namely, payment, funding, asset management, and risk transfer, we forecast the state of finance in ten years based on the aforementioned two changes. Under current Japanese law, main entities providing these four financial functions are banks, non-banks, securities companies, and insurance companies; however, ten years from now, it is likely that a wider range of entities, including non-financial businesses, will also provide these functions (Figure 2).

Figure 2 : Value proposition concerning the classification of financial functions, laws, and major providers

Focusing on the two aforementioned changes, global mosaicization and discontinuous digitalization, this chapter looks ahead to the four aforementioned financial functions ten years from now.

The impact of the global mosaicization of payment functions is evident in the proportion of global foreign-exchange reserves held in US dollars, which, according to IMF data, fell from 65% in 2015 to 58% by 2024. Moreover, against the backdrop of geopolitical tensions such as the US-China conflict and Russia’s invasion of Ukraine, the currency policies of various countries and regions are also moving in independent directions. As a result, Russia, for example, is now holding one-third of the world’s foreign-exchange reserves held in Chinese yuan. For example, in June 2025, the Chairman of the US Federal Reserve, Jerome Powell, emphasized the need to maintain the US dollar’s status as the reserve currency as part of monetary policy by stating, "The dollar’s status as the reserve currency will remain unshakable. It is at the core of US monetary policy." Furthermore, as evidenced by remarks by Treasury Secretary Bessent before the US House of Representatives that “the creation of (private) stablecoins backed by US Treasury securities will help maintain the dominance of the dollar as a reserve currency," the US government is promoting the establishment of legal regulations to maintain the US dollar’s status as a reserve currency by promoting digital and private initiatives as part of its monetary policy. Meanwhile, as evidenced by the President of the European Central Bank (ECB), Christine Lagarde, who stated that "Europe should demand safeguards and a strong equivalence regime from leading foreign stablecoin issuers denominated in US dollars," Europe is promoting state-led monetary policy to maintain its monetary sovereignty. Furthermore, Zhou Xiaochuan, former governor of the People’s Bank of China, stated that "stablecoins linked to the US dollar could accelerate the dollarization of international finance," and he encouraged state-owned enterprises to prioritize payments in Chinese yuan when they are expanding overseas. China is promoting a state-led monetary policy aimed at expanding the yuan’s currency zone and internationalizing countries along the Belt and Road Initiative.

Dramatic improvements in power consumption concerning blockchain payments are driving the discontinuous digitalization of payment functions. For example, the power consumption per payment of "Ethereum," the world’s second-most widely used cryptocurrency, was reduced by 99.9% (from 36 kWh in 2021 to 0.015 kWh in 2023) thanks to advances in consensus algorithms. These advances in blockchain technology will be a key factor in supporting the establishment of blockchain-based digital-payment services and thereby contributing to automated payments using smart contracts and the expansion of the token economy, including the tokenization of real-world assets (RWA).

In the personal sector, one service expected to be provided through utilizing blockchain is automated payments via wallet apps. For example, JR East aims to implement "walk-through ticket gates"—which will eliminate conventional ticket gates—by 2035. Specifically, it plans to introduce facial recognition-linked payments, for which facial information is automatically read inside stations, in a manner that will allow users to pay train fares without even knowing it. In the corporate sector, automated payments will be made simultaneously with contract signing or delivery in a manner that improves the efficiency of payment operations. For example, in 2022, DeCurret and Mitsubishi Corporation conducted a demonstration experiment using smart contracts in trade transactions—namely, payments were made simultaneously with contract signing and delivery—and succeeded in reducing the volume of related payment operations by 80%.

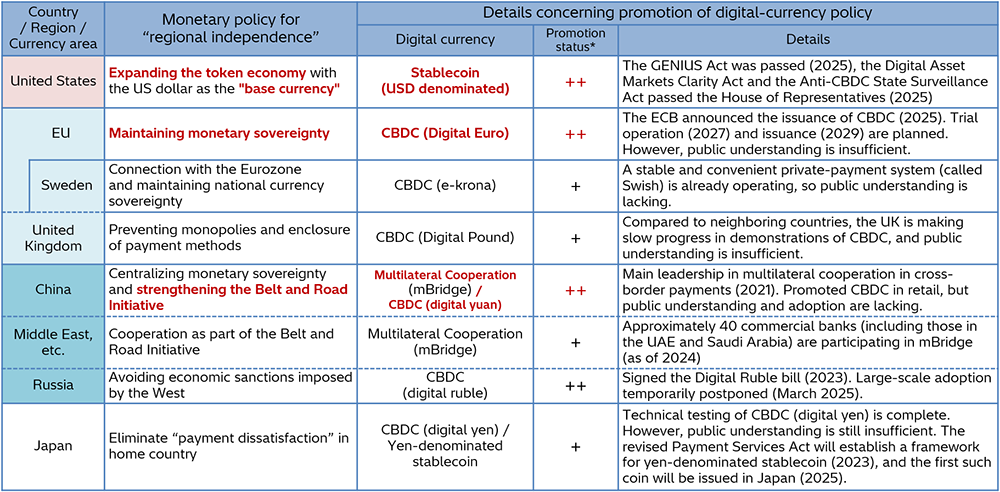

Ten years from now, with the diversification of monetary policies and the evolution of blockchain technology, it is predicted that digital-currency policies in each country and region will become more "regionally specific." First, the United States is aiming to form a token economy led by the private sector, and it is working to establish legal regulations to expand the token economy, which envisions US-dollar-denominated stablecoins as a means of payment. Some of those efforts include three bills: the Genius Act, which establishes a comprehensive regulatory framework for stablecoins; the Anti-CBDC National Surveillance Act, which completely bans CBDCs; and the Digital Asset Markets Clarity Act, which clarifies the classification standards for crypto assets.

Aiming to maintain national-led monetary sovereignty, Europe is taking an active stance toward introducing a retail central-bank digital currency (CBDC) known as the "digital euro." One of the reasons Europe is focusing on the retail sector is the strong presence of US credit-card companies such as Visa and Mastercard in European personal cashless payments. The annual transaction volume in Europe of the two companies is approximately $5.8 trillion, which is equivalent to the estimated personal consumption expenditures of Germany, France, and Italy*3. To maintain Europe’s monetary sovereignty, it is necessary to avoid excessive reliance on foreign payment solutions, such as those provided by US credit-card companies.

China is promoting the state-led retail CBDC "digital renminbi (RMB)," and at the same time, through its One-Belt One-Road Initiative, it is also promoting the “Cross-border International Payment System (CIPS)" (as a rival to SWIFT*4) and the multilateral CBDC collaboration “mBridge." In Japan, while legal frameworks for yen-denominated stablecoins such as “JPYC” have been completed to a certain extent, public acceptance of the issuance of a CBDC by the Central Bank of Japan—called “digital yen”—remains stubbornly low, and the stances of the government and central bank remains unclear. Considering these two changes—the diversification of monetary policies and the development of blockchain technology—we can imagine that as digital-currency policies becoming increasingly "regionalized," payments will be Mosaicked on a national and regional basis in ten years (Figure 3).

Figure 3 : Changes in ten years: Regional uniqueness through multi-polarization of digital-currency policies

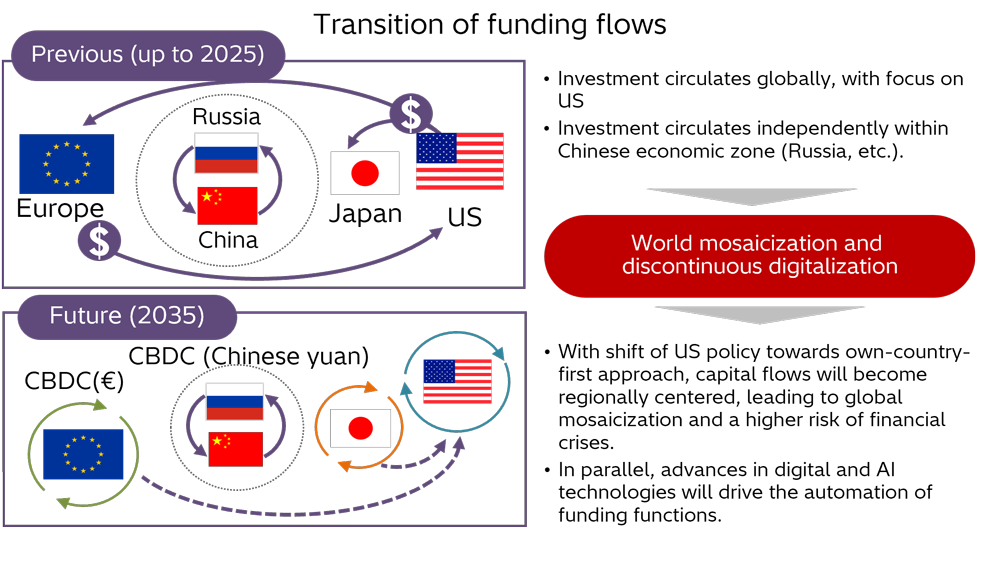

The global trend toward a mosaicization of the funding function is evident in the slowdown in the growth rate of foreign direct investment (FDI), which refers to US acquisitions of companies for business purposes overseas, investments in production facilities, and so on. According to the US Department of Commerce’s Bureau of Economic Analysis, the average annual growth rate of FDI fell from 12% between 1993 and 2003 to 4% between 2013 and 2023, namely, a decline in FDI of about one-third over the past 30 years. Furthermore, the growth rate of investment in China also fell from 29% between 1993 and 2003 to just over 7% between 2013 and 2023, namely, a decline of about one-quarter. These figures indicate that the growth of capital flows from the United States to other countries has been slowing over the long term. In other words, it is becoming relatively difficult to meet the emerging and expanding capital needs of each region with funding from other regions.

The advancement and expanded use of generative AI will significantly improve the productivity of the funding function. According to a McKinsey survey*5, advances in generative AI, particularly in software engineering, are estimated to contribute $48 billion in added value (productivity gains) through improvements in operational efficiency, primarily regarding retail and corporate banking and funding operations, at financial institutions globally. It is estimated that 75% of these productivity gains will come from improvements in the speed of content generation (resulting in improved customer engagement, particularly personalized marketing) and software development and that up to 70% of manual tasks can be automated. The survey also found that more than 50% of European and US banks responded that they have systematically implemented structural reforms, particularly in the areas of data and analytics, which are essential for operational efficiency. The advancement and expanded use of generative AI is therefore likely to improve the productivity of the funding function dramatically through software-based automation of funding operations.

Ten years from now, owing to a slowdown in intra-regional capital flows, the amount of funding available to individuals and corporations in each country and region from other regions will decrease. To meet emerging capital demand within limited regions, it is expected that driven by the advancement and increased use of generative AI, funding will expand through automated and autonomous digital financial services (Figure 4).

Figure 4: Changes in ten years: "Acceleration of intra-regional capital flows" through utilization of digital technology and AI

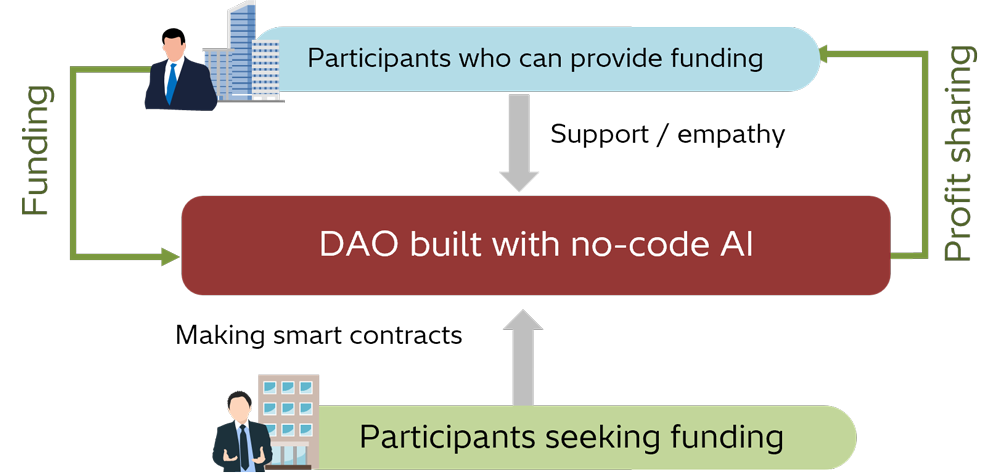

Specifically, with the spread of decentralized autonomous organizations (DAOs), it is expected that future funding sources will expand beyond financial institutions to include individuals and corporations who support or sympathize with business plans (Figure 5). One example is the creation of DAOs, where AI uses natural-language analysis to scrutinize business plans and generate smart contracts (incorporating contract terms such as required funding amounts and profit-sharing rates) automatically. As a result, a wide range of individuals and corporations, including financial institutions, will be able to participate in funding newly created DAOs and receive dividends through profit sharing automatically. The scope of funding provided by DAOs will expand in proportion to the scope of real-world assets that can be tokenized. For example, "NOT A HOTEL DAO," operated by Not A Hotel Inc., tokenizes accommodation rights and makes them available for sale and rental in a manner that enables automatic and autonomous funding to accommodations and landowners. In fact, the “Real-World Asset (RWA)” economy is expected to grow at an average annual growth rate of 53%*6, while the DAO economy is expected to grow at a similar rate of 47%*7.

In Japan, the Liberal Democratic Party has launched the "Web3 Project Team," which aims to utilize DAOs as one of its goals for regional revitalization, and the team is currently working on legal and tax reforms. For example, in August 2025, the yen-denominated stablecoin “JPYC,” which is expected to serve as a stable payment and provision currency for DAOs, will be registered as a funds-transfer business. In this way, the automation of funding using digital technology and AI is also expected to serve as an important foundation for supporting the "acceleration of intra-regional fund circulation" in Japan.

Figure 5: Funding through DAOs automated by utilization of digital technology and AI

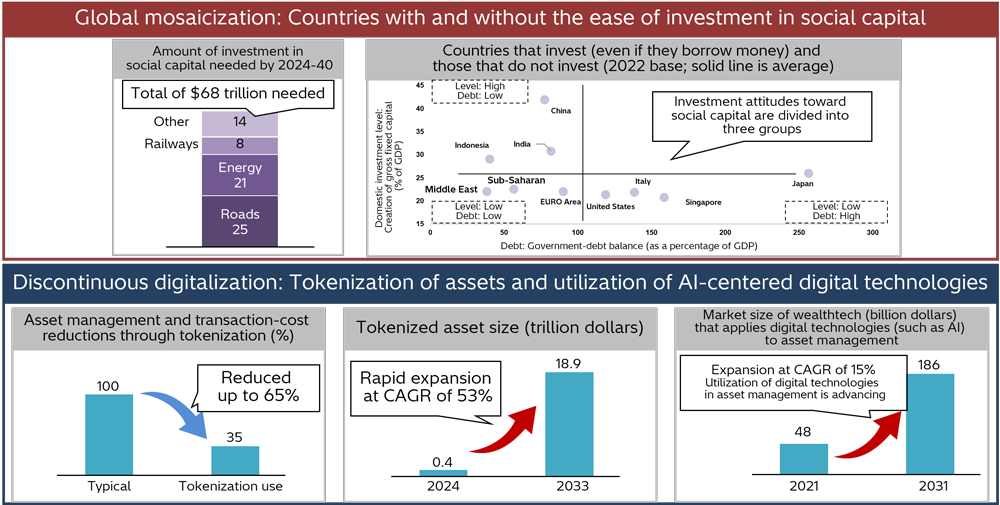

Against the backdrop of increased fiscal burdens following the COVID-19 pandemic and a focus on economic security, differences among countries and regions in investment attitudes toward social capital such as roads and railways are becoming clearer. BlackRock, a US company, estimates that the amount of social-capital investment needed worldwide by 2065 will be $68 trillion*8. However, the feasibility of this investment varies on the financial situation (government debt) and investment level (gross fixed capital formation, GFCF) of each country or region. The first group of countries and regions consists of countries such as Japan and Italy that have significant structural constraints on their finances and have limited room for investing in social capital. As spending on economic-security priorities such as energy security and strengthening defense capabilities increases, budget allocations are prioritized for these areas, so relatively less room is left for investment in social capital. The second group includes countries in regions such as the Middle East and sub-Saharan Africa that have sufficient financial capacity but are cautious when selecting investment destinations. Owing to factors such as security around major logistics routes like the Red Sea, domestic and international political instability, and geopolitical factors, social-capital investment tends to be selectively directed towards strategic areas. The third group consists of countries such as India and Indonesia that are actively promoting social capital investment. In addition to the continuing population increase and high growth of such countries, the inflow of investment due to the attraction of multinational companies and supply-chain restructuring is supporting the expansion of social-capital development accompanied by fiscal leeway. As a result, even though the investments are the same for social capital, the three groups each have their own unique geopolitical backgrounds based on financial status and investment levels and therefore divergent investment stances. These differences have led to differences in the speed at which social capital is formed and updated, and as a result, the world is becoming increasingly "Mosaicked."

As the use of tokenization and AI technologies increases, the asset-management function is undergoing change in two ways: the expansion of investment targets and the sophistication of investment decisions. First, in terms of expanding investment targets, trading in private assets such as social capital, which are not traded on exchanges and only involve a small number of participating investors, has traditionally required the management of rights records using Excel or other tools and the manual collation of investor information, and that requirement makes small-scale transactions costly and inefficient. However, tokenization will automate the updating of rights records and investor information and thereby reduce management costs to close to zero. As a result, it is expected to make it possible to break down assets into smaller amounts regardless of asset size. The Boston Consulting Group in the United States predicted that the global tokenized-asset market would be worth $0.4 trillion by 2024 as it grows at a compound annual growth rate of 53% to reach $18.9 trillion by 2033*9. Next, in terms of improving investment decisions, AI technology is assisting investors in their analytical process in a way that creates an environment in which they can make sophisticated decisions. US companies such as J.P. Morgan and MSCI have begun offering investment analysis and decision-making support tools that use large-scale language models and AI agents, and analytical capabilities that have previously been restricted to financial institutions and experts are becoming more widely available.

Source: Created by Hitachi Research Institute from various materials, including Larry Fink’s 2025 Annual Chairman’s Letter to Investors; IMF data, World Bank Open data; Boston Consulting Group (2025), “Approaching the Tokenization Tipping Point”; and Appinventiv (2025), "The Impact of WealthTech in Finance".

Figure 6: Background to the increasing "democratization of investment" about asset-management functions

While differences in national and regional financial conditions and investment levels are leading to a growing division between countries where it is easy to invest in social capital and those where it is difficult, the mosaicization of investment targets through tokenization opens new avenues for capital inflows for those seeking capital. For example, by using tokenization technology to divide the rights to invest in large-scale assets such as data centers and airports into smaller units and making them tradable as digital securities, individual investors, even those with investments of just a few hundred dollars, can now participate in projects that were previously only available to large investors. Furthermore, with the support of advanced investment decisions using AI, even average investors can acquire judgment skills comparable to those of experts. As a result, markets that were previously closed to a select group of investors will be transformed into open markets where a diverse range of entities can participate in a manner that advances the "democratization of investment."

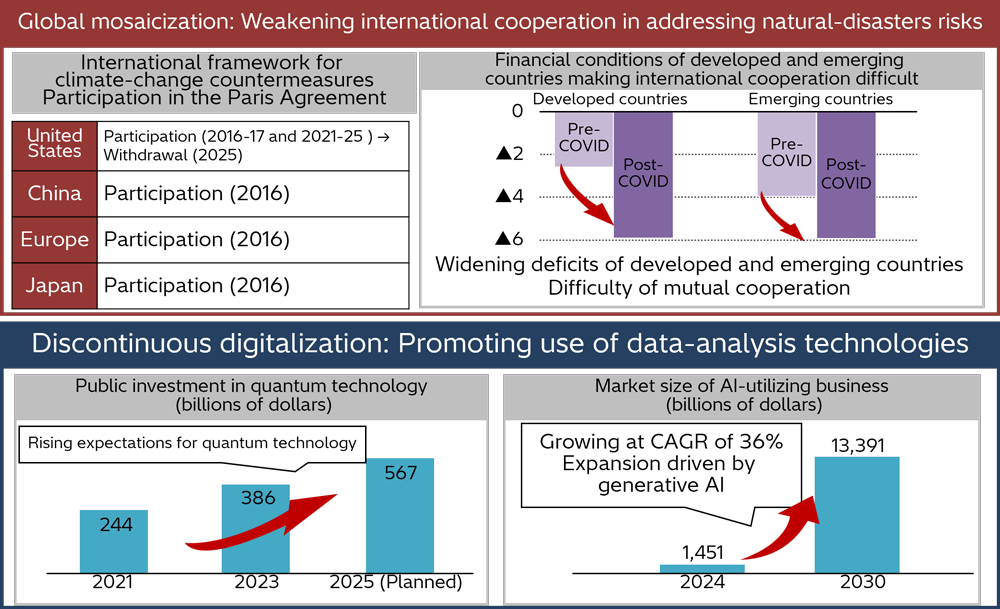

The international framework for cooperation in addressing natural disaster risks is increasingly weakening. In particular, the withdrawal of the United States from the Paris Agreement on global-warming countermeasures and worsening fiscal constraints in both developed and emerging countries have made it difficult to continue international financial assistance. This lack of international cooperation has weakened mechanisms for globally distributing damages from natural disasters and thus resulted in a growing tendency for risk attribution to be left to individual regions, countries, and entities. In fact, in Europe, where only about 25%*10 of economic losses from natural disasters are covered by insurance, with the aim of strengthening risk-transfer functions within European countries and the private sector, the European Insurance and Occupational Pensions Authority, together with the European Central Bank, has proposed the establishment of a public-private reinsurance scheme and a European-level public disaster fund.

Data analysis using AI, quantum computers, and high-performance computing (HPC) is advancing in the form of technologies supporting risk-transfer functions. These technologies are improving the accuracy of meteorological models and damage forecasts, and the results of such forecasts are already being applied. For example, in Spain, Mitiga Solutions is using AI to quantify the risk of volcanic-ash-related disasters. The Danish Red Cross has used this technology to issue "parametric catastrophe bonds." And in the US, Moody’s is using quantum computers and HPC to refine the probability of manifestation of tropical cyclone risk in a manner that is helping to improve assessment capabilities of risk underwriters. Against the backdrop of these technological efforts, for example, the underwriting volume of catastrophe bonds continued to expand at a compound annual growth rate of 10% from 2020 to 2024 and reached a record high in 2024.*11

Source: Created by Hitachi Research Institute from various materials, including Mizuho Research & Technology (2025), "Signs of increasing risk of interest-rate rises due to fiscal concerns"; Qureca, (2021, 2023, and 2025), "Quantum Initiatives Worldwide"; and Artemis (2025), “Catastrophe bonds & ILS issued and outstanding by year”.

Figure 7: Background to the increasing "flexibilization" of risk-transfer functions

As international cooperation falters, each region, country, and entity is forced to establish risk-assessment and diversification mechanisms suited to its own circumstances and risk characteristics. In this context, "discontinuous digitalization," exemplified by AI as well as quantum computing and HPC, is beginning to function as the technological foundation supporting autonomous responses. These changes are enabling the risk-transfer function to shift away from the traditional uniform risk assessment and toward "flexibility," which allows each region, country, and entity to assess, diversify, and assume risk flexibly according to its own circumstances and tolerance. The “flexibilization” in the risk-transfer function is expected to be a direction for financial development that will curb the increasing number of uncompensated losses due to natural disasters and increase the resilience of society.

The two aforementioned changes —global mosaicization and discontinuous digitalization—will drive the four basic financial functions of payment, funding, asset management, and risk transfer to evolve into new forms (Figure 8). As these functions evolve into the above-described four financial functions in 10 years, a wide variety of businesses will be formed and expanded.

Figure 8: Changes in 10 years due to two changes in the four financial functions

As the "Regional uniqueness" of digital currencies and payment systems progresses, globally shared payment systems will be reorganized into regional economic zones in which each region builds its own monetary policies and payment networks while considering its own monetary sovereignty and economic security. In conjunction with this trend, technological infrastructure and system design will be standardized to ensure the efficiency and security of intra-regional payments, and payment infrastructure based on common specifications will be established within the region. Based on these common specifications, various digital payment methods will be implemented in an interoperable manner within each region, and transaction-data formats and management platforms will also be standardized. As a result, data that was previously dispersed among individual payment-service providers and difficult to cross-reference will be able to be managed and analyzed in an integrated manner within the region. This capability will enable precise understanding of the flow of commerce, money, and logistics throughout the regional economy. It is thus expected to lead to an expansion of management-support businesses such as forecasting consumer behavior and product demand.

The mosaicization of global capital flows is forcing countries and regions to reduce their reliance on external funds and shift to structures that maximize the circulation of funds within the region. Through this process, the spread of generative AI and smart-contract technology has led to the formation of RWAs and DAOs.

Traditionally, in the case of centralized financial systems, banks and public institutions guarantee the authenticity of assets and contracts. However, in an autonomous decentralized environment, there is no auditing body that can fulfill that role, so it is essential to have a system that can accurately capture, track, and prove the rights and interests of token assets in the digital space. Against this backdrop, it is predicted that demand will grow for trust businesses that verify authenticity and audit contracts on the blockchain.

Advances in tokenization technology have opened private markets that were previously limited to a part of institutional investors and the wealthy in a way that has allowed ordinary investors to participate with small amounts of money. While this change has led to a diversification of capital-inflow sources for fundraisers and created a variety of investment opportunities for investors, the expansion of the investor base also brings new challenges. In other words, since each investor has different investment objectives and decision-making time frames, it is a concern that a disparity in the level of understanding of the inherent social significance and long-term nature of investment targets will appear. As a result, long-term, low-profit assets such as social capital may not be properly valued by the market. That situation might lead to capital inflows and outflows that are influenced by short-term price fluctuations. Such market instability could lead to an underestimation of the public nature and social significance of social capital assets, which could hinder sustainable capital formation. To address this issue, it is necessary to implement a system that positions “social return” as information that strengthens the predictability of financial return and makes it easier to understand the value structure and future profitability of investment targets. By supporting rational investment decisions concerning long-term assets through the visualization of social outcomes, an environment in which investment in assets with a high level of public value can be sustained within the market system will be created, and it is anticipated that this environment will lead to the formation of "value co-creation finance" that balances social significance with capital circulation.

The weakening of international-cooperation systems for managing natural disaster risk has created an increasing need for each entity to build a system that optimally diversifies risk according to its own financial situation and risk tolerance. In this environment, the development of advanced analytical technology has enabled estimation and evaluation of autonomous risk. As a result, new financial products targeting natural disaster risks that could not previously be covered are appearing one after another. As a result of the diversification of various risks, the risks faced by both underwriters and transferors have become more complex, so it has become necessary to calculate the optimal holding and transfer ratios for each risk. In such an environment, it is expected that the risk-portfolio-optimization business, which uses high-performance computing to derive combinations that balance risk-taking with stable profits, will flourish.

In those ways, due to the two changes of global mosaicization and discontinuous digitalization, it is expected that the working methods used by the four financial functions will change to suit the characteristics of each country and region: as for payments, data integration within the region will progress; as for funding, mechanisms to support the authenticity of token assets will become increasingly important; as for asset management, the diversification of investors will require the visualization of social outcomes; and as for risk transfer, evaluation and diversification according to the circumstances of each risk owner will progress. As a result, the frameworks for transactions, data, and evaluation created by these four financial functions will become more prominent as a social infrastructure for value creation, and their role is expected to become more widely accepted in society. Hitachi Research Institute will continue its research to clarify how the four financial functions will specifically evolve and what new values will be created by this evolution.

Ippei Nishida

Group Leader & Senior Researcher, Financial Strategy and Society Research Group, 1st Research Department, Hitachi Research Institute

Yusuke Matsumoto

Researcher, Financial Strategy and Society Research Group, 1st Research Department, Hitachi Research Institute

Author’s Introduction

Ippei Nishida

Group Leader & Senior Researcher,

Financial Strategy and Society Research Group,

1st Research Department

Yusuke Matsumoto

Researcher,

Financial Strategy and Society Research Group,

1st Research Department

We provide you with the latest information on HRI‘s periodicals, such as our journal and economic forecasts, as well as reports, interviews, columns, and other information based on our research activities.

Hitachi Research Institute welcomes questions, consultations, and inquiries related to articles published in the "Hitachi Souken" Journal through our contact form.