~ The future of risk money that has supported the U.S. economy ~

Dec. 17, 2025

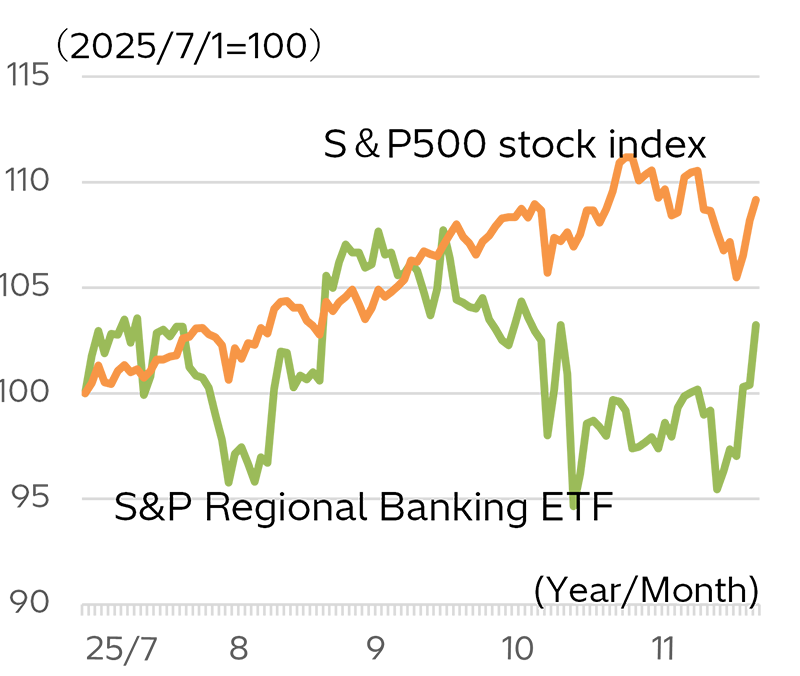

Figure 1: Trends in U.S. regional bank stock prices

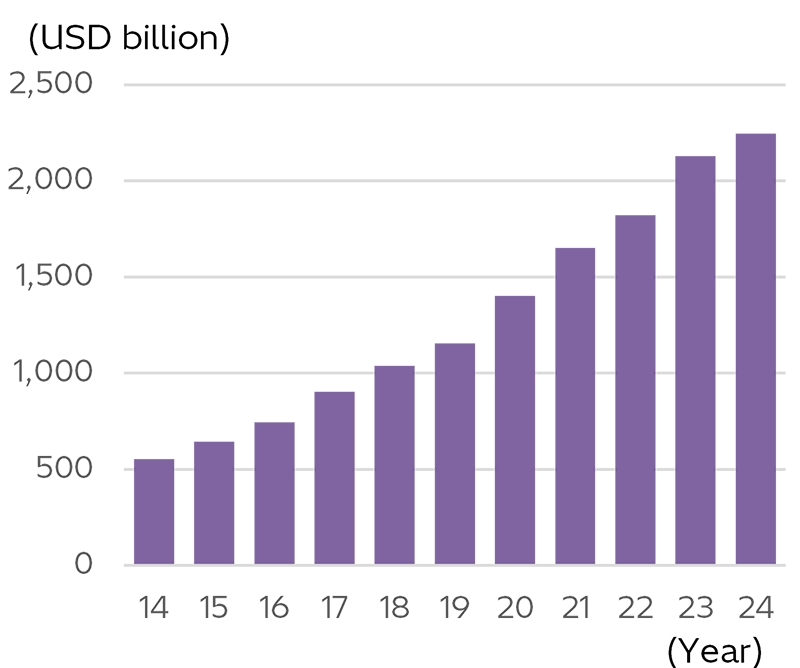

Figure 2: Private credit AUM outstanding

Kenichiro Yoshida

Chief Researcher, Global Intelligence and Research Office, Hitachi Research Institute

Engaged in research on economic and financial conditions in the United States and Europe. After graduating from Hitotsubashi University's Faculty of Commerce, he worked at Mizuho Research Institute and served as the Chief Representative of Mizuho Research Institute's London Office before assuming his current position in 2021.

Author’s Introduction

Kenichiro Yoshida

Chief Researcher

Global Intelligence and Research Office

We provide you with the latest information on HRI‘s periodicals, such as our journal and economic forecasts, as well as reports, interviews, columns, and other information based on our research activities.

Hitachi Research Institute welcomes questions, consultations, and inquiries related to articles published in the "Hitachi Souken" Journal through our contact form.