Jan. 27, 2026

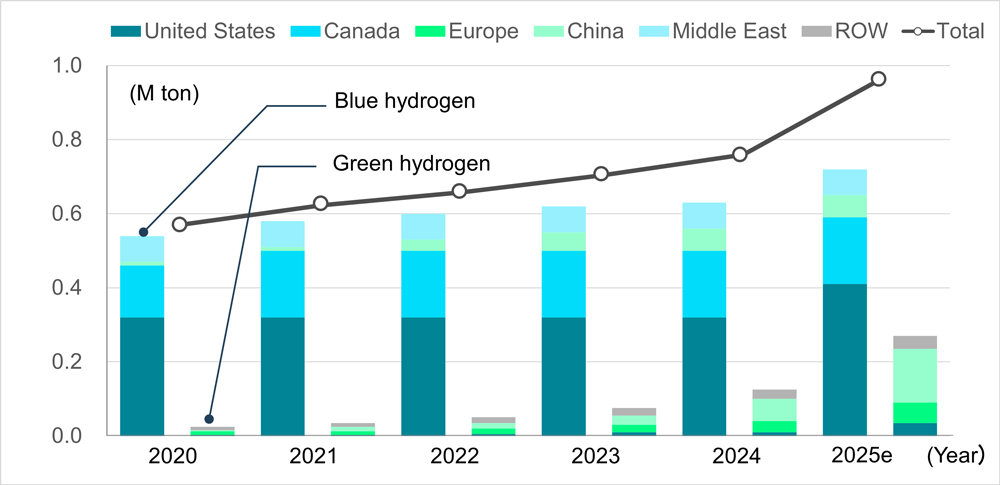

Green and blue hydrogen*1, regarded as key solutions for decarbonization and energy security, reached a combined global production volume of over 700,000 tons in 2024, marking a 10% increase from the previous year (Figure 1). However, this amount accounts for only about 1% of the total hydrogen currently produced, which is primarily used for industrial and oil refining purposes. Most of the hydrogen produced today is gray hydrogen derived from fossil fuels. Most blue hydrogen production takes place in the United States and Canada, while more than half of green hydrogen production is in China, where expansion continues under the favorable influence of government hydrogen strategies. Manufacturers capable of supplying water electrolysis systems at low cost are emerging in China, and they are increasing their presence in overseas markets such as Europe.

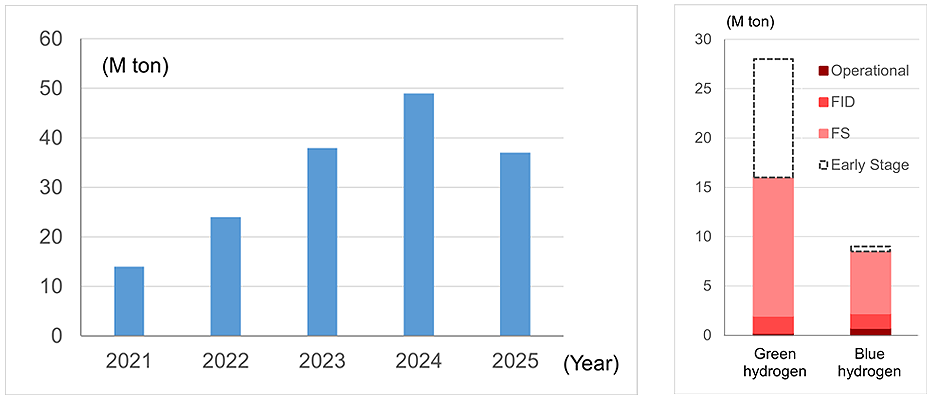

On the other hand, looking at the planned 2030 production volumes for green and blue hydrogen projects announced worldwide, the figures have started to decline as of 2025 (Figure 2, left). Furthermore, only 9% of the planned capacity for 2025 has reached Final Investment Decision (FID), with the majority still at the feasibility study or early planning stages (Figure 2, right).

Figure 1: Global trends in green and blue hydrogen production volumes

Figure 2: Trends in planned global production volumes of green and blue hydrogen for 2030 (left) and the status as of 2025 (right)

The background is that, since around mid-2024, there has been a growing trend of withdrawals and reviews of hydrogen-related projects worldwide (Table 1). The main factors include persistently high hydrogen production costs due to soaring material and construction expenses, as well as the suspension of government support, which has made these projects financially unviable. In addition, many projects appear to have been speculative, lacking detailed planning; in some cases, it became evident that sufficient hydrogen demand could not be expected.

Going forward, it is expected that hydrogen projects with viable profitability will be selectively pursued. For example, in its medium-term management strategy announced in February 2025, BP revealed its plan to significantly reduce spending on “energy transition businesses” and shift toward increasing oil and gas production. While withdrawing from hydrogen projects that are unlikely to generate returns, BP continues to invest selectively in projects expected to be profitable, such as the Lingen Green Hydrogen project in Germany.

| Company(Industry) | Project location | Content | Reason for withdrawal and review | Disclosure timing |

|---|---|---|---|---|

| Stanwell (Energy) |

Australia |

|

Low profitability (high hydrogen production costs and termination of government support) | June 2025 |

| BP (Oil) |

Australia |

|

High risks and low profitability | July 2025 |

| Shell (Oil) |

Norway |

|

Insufficient hydrogen demand | September 2024 |

| ArcelorMittal (Steel) |

Germany |

|

Low profitability (suggested high plant operating costs) | June 2025 |

Policy support in each country and region is shifting from research and development focused on the hydrogen production stage to social implementation support that emphasizes the utilization stage, with the EU, Germany, and Japan continuing to reinforce their efforts (Table 2). Support periods of 10 to 15 years have become the standard. As for China, large-scale government subsidies have not yet been introduced, but discussions on their necessity have begun.

In May 2022, the EU formulated the “REPowerEU” plan, setting an ambitious target of supplying 20 million tons of green hydrogen by 2030 (split evenly between domestic production and imports). Through the “hydrogen bank” mechanism, the EU is supporting hydrogen production within the region. However, many industry stakeholders believe that achieving the 2030 green hydrogen supply target will be difficult. In addition, European Commission officials have stated that the hydrogen strategy will be updated in 2026. In July 2023, Germany revised its National Hydrogen Strategy and set a goal of covering 50 to 70% of its hydrogen demand through imports. It is promoting the “H2 Global” project in collaboration with the Netherlands to support the import of green hydrogen. In May 2024, Japan enacted the Hydrogen Society Promotion Act and launched the world’s largest price-gap support program (3 trillion yen), which subsidizes the price difference between low-carbon hydrogen—defined as hydrogen with low CO2 emissions during production—and existing fossil fuels.

In the United States, the Inflation Reduction Act enacted in August 2022 included tax credits for green hydrogen production, which were expected to significantly improve project profitability. However, under the One Big Beautiful Bill Act passed in July 2025, the deadline for starting eligible construction was brought forward, resulting in a reduction of support. In October 2025, the Trump administration announced the termination of USD 7.56 billion in funding for 223 decarbonization-related projects (details of the affected projects have not been disclosed). Among the seven “hydrogen hubs” (integrated regions for hydrogen production and utilization systems) that were supported under the Biden administration, funding totaling USD 2.2 billion for projects in Democratic strongholds, such as California and the Northwestern hub spanning Washington and Oregon, appears to have been canceled (according to a Bloomberg report).

In March 2022, China’s central government released the Medium-Term Plan for the Development of the Hydrogen Energy Industry, and local governments subsequently formulated hydrogen promotion plans to attract industry players. Against this backdrop, state-owned enterprises such as Sinopec and CNPC have launched large-scale hydrogen production projects. Recently, industry stakeholders have begun voicing concerns about the high cost of green hydrogen, and discussions on subsidy policies, such as price-gap support, are starting to emerge.

| EU | Germany | Japan | |

|---|---|---|---|

| Hydrogen supply target (2030) |

20 million tons (50% from within the region and 50% from imports) |

2.85 to 3.9 million tons (50 to 70% from imports) |

3 million tons |

| Cost target (2030) |

n.a. | n.a. | 30 yen/Nm3 (about 334 yen/kg) |

| Key support policy |

|

|

|

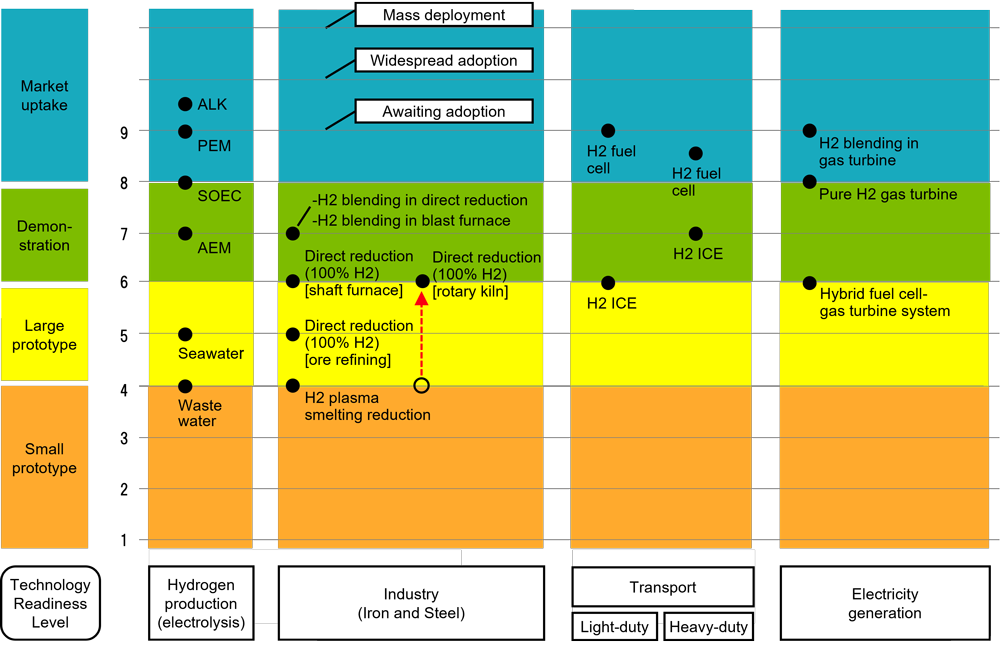

According to the International Energy Agency, the number of technologies whose Technology Readiness Level (TRL) advanced over the past year was the highest in the last five years. However, when focusing on key technologies at the hydrogen production and utilization stages, there has been little significant progress in TRL (Figure 3, where upward arrows indicate advancements in technology development).

For hydrogen production, ALK (alkaline) and PEM (proton exchange membrane) electrolysis are currently at the market uptake stage, but they have not yet reached widespread adoption or mass deployment. SOEC (solid oxide electrolyser cell) and AEM (anion exchange membrane), which are expected to help reduce costs, remain at the demonstration stage. In the steel industry, various direct reduction technologies are under development, but they are still at the prototype or demonstration stage. Most recently, a sealed rotary kiln method using German technology has advanced to the demonstration phase. In transport, hydrogen fuel cell vehicles remain at the stage of awaiting adoption. Similarly, in electricity generation, hydrogen blending in gas turbines is also still at the pre-adoption stage.

In December 2024, BloombergNEF significantly revised its outlook on green hydrogen costs, adopting a more conservative view on cost reductions. Previously, its forecast projected that a cost of USD 2/kg could be achieved globally, including in countries such as China, the United States, Germany and Japan, by 2037*2. Under the revised outlook, however, the USD 2/kg level is now expected to be attainable only in China and India by 2050.

Figure 3:Technology readiness levels of hydrogen-related technologies

Projects that are progressing smoothly do not focus solely on the supply side of hydrogen production; instead, they develop the demand side in parallel while securing (1) government support, (2) promising customers, and (3) investment funds to enhance project feasibility (Table 3). In particular, securing investment funds also implies conducting rigorous reality checks from the investors’ perspective. Furthermore, some projects adopt a strategy of starting at an appropriate small scale and then gradually expanding operations.

As shown in Table 3, advanced projects primarily target industries with large hydrogen demand. By contrast, projects aimed at sectors where hydrogen demand is still in its early stages, such as urban districts, buildings, transportation, and residential consumers, remain at the demonstration stage and have not yet reached commercial deployment (Table 4).

| Project name (Location) |

Overview | Government suppor | Promising customers | Investment funds |

|---|---|---|---|---|

|

Project name(Location)

Stegra Green Steel (Sweden) |

|

|

|

|

|

Project name(Location)

Lingen Green Hydrogen (Germany) |

|

|

|

|

|

Project name(Location)

HySynergy Green Hydrogen (Denmark) |

|

|

|

|

| Project name (Location) |

Overview | Project activities |

|---|---|---|

| HEAVENN Hydrogen Valley (Netherlands) |

|

|

| Ulsan Hydrogen Pilot City (South Korea) |

|

|

Naofumi Sakamoto

Senior Strategy Staff, Global Intelligence and Research Office

He is engaged in research on policy and industry trends in the fields of energy and environment.

He joined Hitachi in 1992 and has worked on development of global strategy and service-business strategy before assuming his current position.

Author’s Introduction

Naofumi Sakamoto

Senior Strategy Staff,

Global Intelligence and Research Office

We provide you with the latest information on HRI‘s periodicals, such as our journal and economic forecasts, as well as reports, interviews, columns, and other information based on our research activities.

Hitachi Research Institute welcomes questions, consultations, and inquiries related to articles published in the "Hitachi Souken" Journal through our contact form.