Dec. 12, 2025

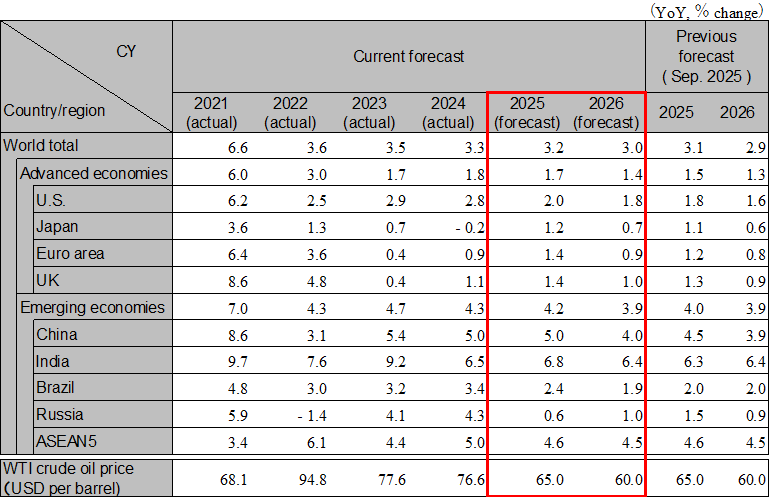

Disruption around the Trump tariffs is expected to subside, giving the world economy a seemingly stable start in 2026. Growth will likely proceed at a somewhat slow pace in the first half, but—supported by expansionary fiscal stances and accommodative monetary policy across countries—the annual average is expected to hold around 3%. That said, close attention is warranted to the risk of a rapid contraction of the liquidity boom, particularly around AI-related investment, and the potential spillovers to the real economy. Additional risks include an inflation‑triggered U.S. recession stemming from policy missteps, and a clearer manifestation of deepening weakness in China. World real GDP growth: 3.2% in 2025 and 3.0% in 2026.

The US economy is maintaining resilience even as deterioration in labor market conditions continues. There is support to consumption from favorable stock prices, and an expansion of private investment supported by AI-related demand. These tendencies will continue into 2026 as well, and the US economy is highly likely to remain resilient, centered on domestic demand. However, attention is required to the risks that the US economy could fall into recession due to policy missteps—such as expansionary fiscal policy, the Fed’s accommodative monetary policy, and the effects of tariffs—and to the possibility that, with excessive stock-price increases centered on AI accelerating, the economy could sharply decelerate along with a bursting of the bubble. Real GDP growth in the U.S. is 2.0% in 2025 and 1.8% in 2026.

The Euro area economy is seeing an improvement in sentiment centered on defense and infrastructure investment. With the 2026 budget also nearing passage, the Euro area economy is expected to see a moderate recovery next year as well. On the other hand, political uncertainty is increasing in countries such as France and the UK, and if government bond yields rise further, investment is expected to be restrained. The ECB is expected to keep its policy rate near 2% throughout 2026. In the UK, the inflation rate is high compared with other European countries, and the BOE is expected to continue cutting rates at a cautious pace. Real GDP growth in the euro area is expected to be 1.4% in 2025 and 0.9% in 2026. Real GDP growth in the UK is 1.4% in 2025 and 1.0% in 2026.

China's economy continues to grow steadily with the contribution of consumption. On the other hand, business confidence in the manufacturing sector is weakening due to lower profit margins caused by intensified domestic competition. Export growth is unlikely to be significant amid tariffs on exports to the U.S. and increased anti-dumping measures on Chinese products in response to deflated exports. Investment growth in 2026 is expected to be sluggish, especially in the manufacturing sector. Consumption growth is expected to be limited due to the preemption of demand, despite the continuation of government stimulus measures. In the next 15th Five-Year Plan, national security will be the top priority, and economic growth will be allowed to slow to a certain degree. Real GDP growth will be 5.0% in 2025 and 4.0% in 2026.

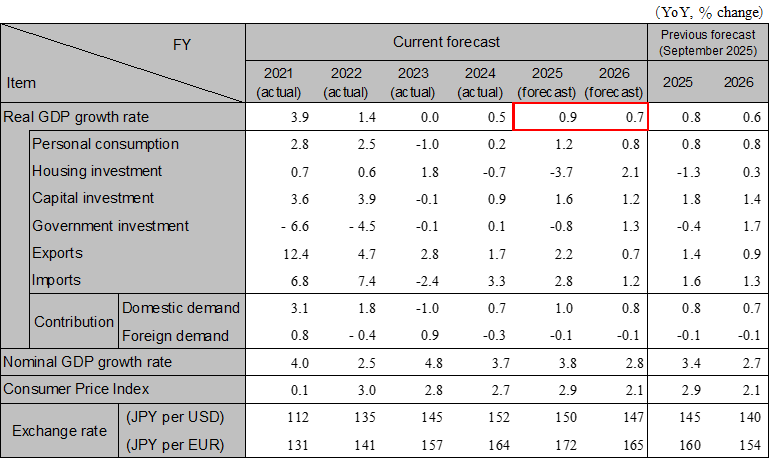

Despite stagnant exports, Japan's economy as a whole is expected to continue to recover due to firm domestic demand, especially for capital investment. Although food inflation will continue, consumption will continue to recover, due to improved wages and the new administration's measures to reduce household burdens. Capital investment will remain firm, especially in the non-manufacturing sector, due to upward revisions to earnings forecasts and improved business confidence. industrial competitiveness may increase due to the administration's focused investment in national strategic areas such as AI and semiconductors, but caution is needed regarding the risk of monetary policy taking a back seat and causing exchange rate, stock, and bond depreciation. Real GDP growth is expected to be 1.2% in 2025 (0.9% for the fiscal year) and 0.7% in 2026 (0.7% for the fiscal year).

India is expected to maintain strong growth, supported by the anticipated reduction of U.S. high tariffs and consumption stimulus from the revision of the Goods and Services Tax (GST). Manufacturing will gradually expand, but for now, services remain the main driver, with growth projected at 6.8% in FY2025 and 6.4% in FY2026. ASEAN-5 is also expected to sustain stable growth in the 4% range on average. While conditions vary by country, tariff impacts have eased, and no major shifts in the overall economic outlook are anticipated. However, attention is needed to risks such as a sharp slowdown in the U.S. and China, and prolonged excess supply from China. ASEAN-5 real GDP growth: 4.6% in 2025 and 4.5% in 2026.

Note: Values for Japan differ from those shown in the table below on a fiscal-year basis because they are on a calendar-year basis. India’s figures are shown on a fiscal-year basis. ASEAN5 is comprised of Indonesia, Thailand, Malaysia, the Philippines, and Vietnam.

Source: Actual figures are from the IMF, forecasts are from the IMF (Brazil and Russia), and Hitachi Research Institute (others)

Note: The individual numbers and their sum may not match due to fractional processing.

Source: Cabinet Office, forecasts by Hitachi Research Institute

We provide you with the latest information on HRI‘s periodicals, such as our journal and economic forecasts, as well as reports, interviews, columns, and other information based on our research activities.

Hitachi Research Institute welcomes questions, consultations, and inquiries related to articles published in the "Hitachi Souken" Journal through our contact form.