Latest economic forecasts for Japan, the U.S., Europe, and China, etc

Global economy to remain in “fragile stability” in 2024

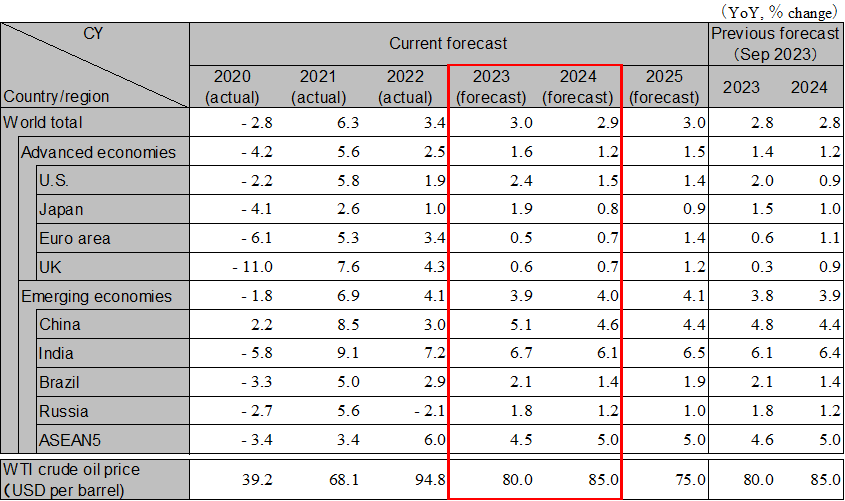

Geopolitical risks such as the situation in the Middle East are rising, and the outlook for the global economy is highly uncertain. The global economy in 2024 is expected to remain in a state of “fragile stability” with risks such as geopolitical instability, turmoil in financial markets, and a resurgence of inflation. The growth rate is expected to be 3.0% in 2023 and 2.9% in 2024, with a recovery toward 2025, but we must remain wary of downside risks throughout 2024.

By the end of 2023, the U.S. economy is expected to grow at a high rate in the mid-2% range, supported by strong domestic demand such as consumer spending. However, due to the cumulative effect of the Fed’s interest rate hikes, the U.S. economy is expected to slow moderately in the first half of 2024. With the economic slowdown, labor supply and demand will ease and the employment environment will deteriorate. We expect that the underlying inflation rate will continue to decline and the Fed will begin to cut policy rates from June 2024. The U.S. economy is expected to start recovering in the second half of 2024, partly due to the effect of the interest rate cut. Real GDP growth is expected to be 2.4% in 2023 and 1.5% in 2024.

By the end of 2023, the eurozone economy is expected to grow at a low rate of around 0.5%, mainly due to a decline in purchasing power caused by inflation. The economy will start to recover from mid-2024 onwards as real wages recover and China’s economy stabilizes. The ECB is expected to start cutting interest rates from June 2024 after confirming a decline in underlying inflation. The year 2024 is expected to see a moderate recovery in the UK economy due to slower inflation and higher wages. Real GDP growth for the euro area is expected to be 0.5% in 2023 and 0.7% in 2024. Real GDP growth for the UK is expected to be 0.5% in 2023 and 0.7% in 2024.

The Chinese government will invest an additional RMB 1 trillion (0.8% of GDP) in infrastructure construction, including flood reconstruction and prevention, in response to the slowdown in the economy. The economy will be boosted by infrastructure investment in the first half of 2024. The property market, which continues to stagnate, has been taken measures by the PBOC by cutting policy interest rates and encouraging financial institutions to lending developers. Although consumption is slow due to falling property values and job insecurity, we expect a gradual recovery in second half of 2024 as completion of unfinished property and adjustment of inventory progress. However, growth will decline over the medium term amid structural problems such as rising debt, slowdown of foreign capital inflows and youth unemployment. Real GDP growth rates are expected to be 5.1% in 2023 and 4.6% in 2024.

India continued to grow steadily, supported by firm domestic demand, including infrastructure investment and consumption. Inflation is generally within the inflation target range, and the suspension of interest rate hikes since April 2023 has mitigated the risk of downward pressure on the economy. The growth rate is forecast to be 6.7% in FY2023 and 6.1% in FY2024. ASEAN economies generally continuing to recover, but the pace of growth is somewhat uneven from country to country. Growth rates are expected to be 4.5% in 2023 and 5.0% in 2024.

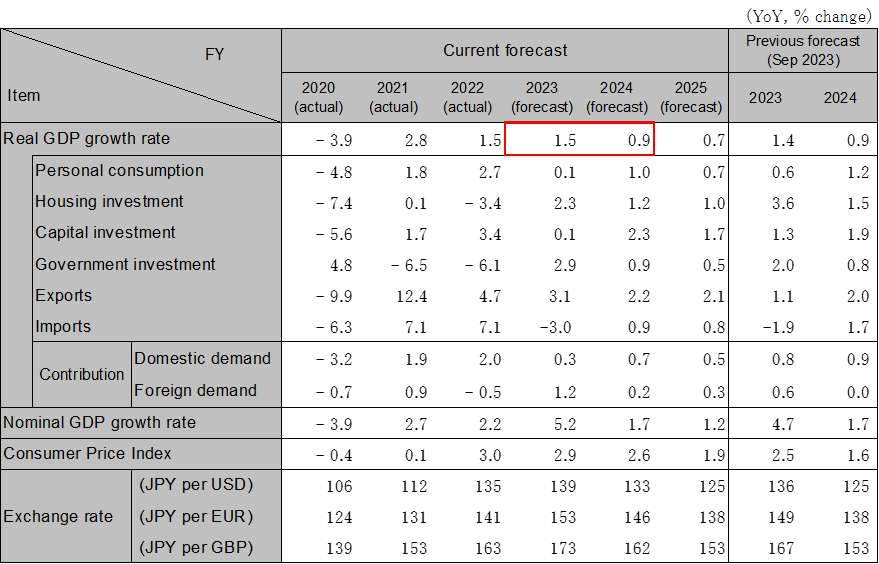

In FY2023, the Japanese economy is expected to grow in the mid-1% range due to a recovery in exports and inbound demand, etc. In FY2024, a moderate recovery is expected to continue due to such as increased consumption supported by real wage recovery, economic measures, and the emergence of capital investment. Based on the favorable conclusion outlook for the annual wage talks (Shunto), BOJ is expected to expand or eliminate the upper limit of yield curve control and eliminate negative interest rates in spring 2024. Capital investment has been somewhat weak at present, although a high level of investment is planned. We expect investment, which has lagged behind planned levels, to materialize in FY2024, with high ordinary income. Exports have been strong, but the global economic slowdown is a downside risk factor. Growth rates are forecast to be 1.5% in FY2023 (1.9% in CY 2023) and 0.9% in FY2024 (0.8% in CY 2023).

Note:Values for Japan differ from those shown in the table below on a fiscal-year basis because they are on a calendar-year basis. However, India’s figures are shown on a fiscal-year basis. ASEAN5 is comprised of Indonesia, Thailand, Malaysia, the Philippines, and Vietnam.

Source: IMF, forecasts by Hitachi Research Institute

Note:The individual numbers and their sum may not match due to fractional processing.

Source: Cabinet Office, forecasts by Hitachi Research Institute