最新の海外書籍・論文を研究員独自の目線で紹介

Ajay Kumar Airan

Deputy General Manager,

Hitachi Research Institute Unit, MD Office, Hitachi India Pvt. Ltd.

The Indo-Pacific region is geographically a triangle, having Japan on its northern boundary, Australia on southeastern, and India in southwestern. The 10-nations group ASEAN (Association of Southeast Asian Nations) falls in this triangular region.

In fact, the concept of Indo-Pacific has been advancing from a strategic and geo-political perspective rather than simply geographic. Japan’s relation with India and Australia gained momentum on the grounds of security co-operation. Over the last decade, this triangle evolved and joined by the U.S. – forming QUAD (Quadrilateral Security Dialogue) with a vision of ‘Free and Open Indo-Pacific’. With this background, this paper covers the IPEF (Indo-Pacific Economic Framework for Prosperity) as the latest addition to rising global economic and political interest in Indo-Pacific and points out how it can benefit ASEAN nations in terms of digital inclusion and foreign investments.

Author of this paper, published in July 2022, is Sherillyn Raga (Ms). Her policy-oriented research covers Asian and African macroeconomics, financial integration, trade, and investment.

The IPEF was launched by the U.S. President Joe Biden on May 23, 2022. It includes 14 founding member nations (4 QUAD members; 7 from ASEAN, plus Republic of Korea, New Zealand, Fiji). It is also open for other nations to join any time.

IPEF has launched with four pillars: I. Trade (digital economy); II. Supply Chains (resilience); III. Clean Energy, Decarbonization, and Infrastructure; IV. Tax and Anti-Corruption. It is not FTA (free trade agreement), hence no binding commitment to reduce trade tariffs. Instead, it is an ‘economic arrangement’. Another notable point is that IPEF framework is flexible, i.e., members are not required to join all the four pillars. For instance, India is opting out of the trade pillar for now till broader consensus emerges on it.

The paper highlights IPEF as a signal of the revival of the U.S. involvement in Indo-Pacific after withdrawal from the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) five years ago. Another notable point is non-membership of the U.S. in the Regional Comprehensive Economic Partnership Agreement (RCEP) where China is said to be a dominant player, but the exclusion of China in the U.S.-led IPEF. This reflects strategic importance of IPEF for the U.S. amid friction between the world’s two superpowers and Indo-Pacific region.

The paper points out that ASEAN is in the middle of these multilateral agreements in Indo-Pacific – be it RCEP, CPTPP, and now IPEF. This makes the ASEAN nations highly significant in the global trade flow as well as geopolitically.

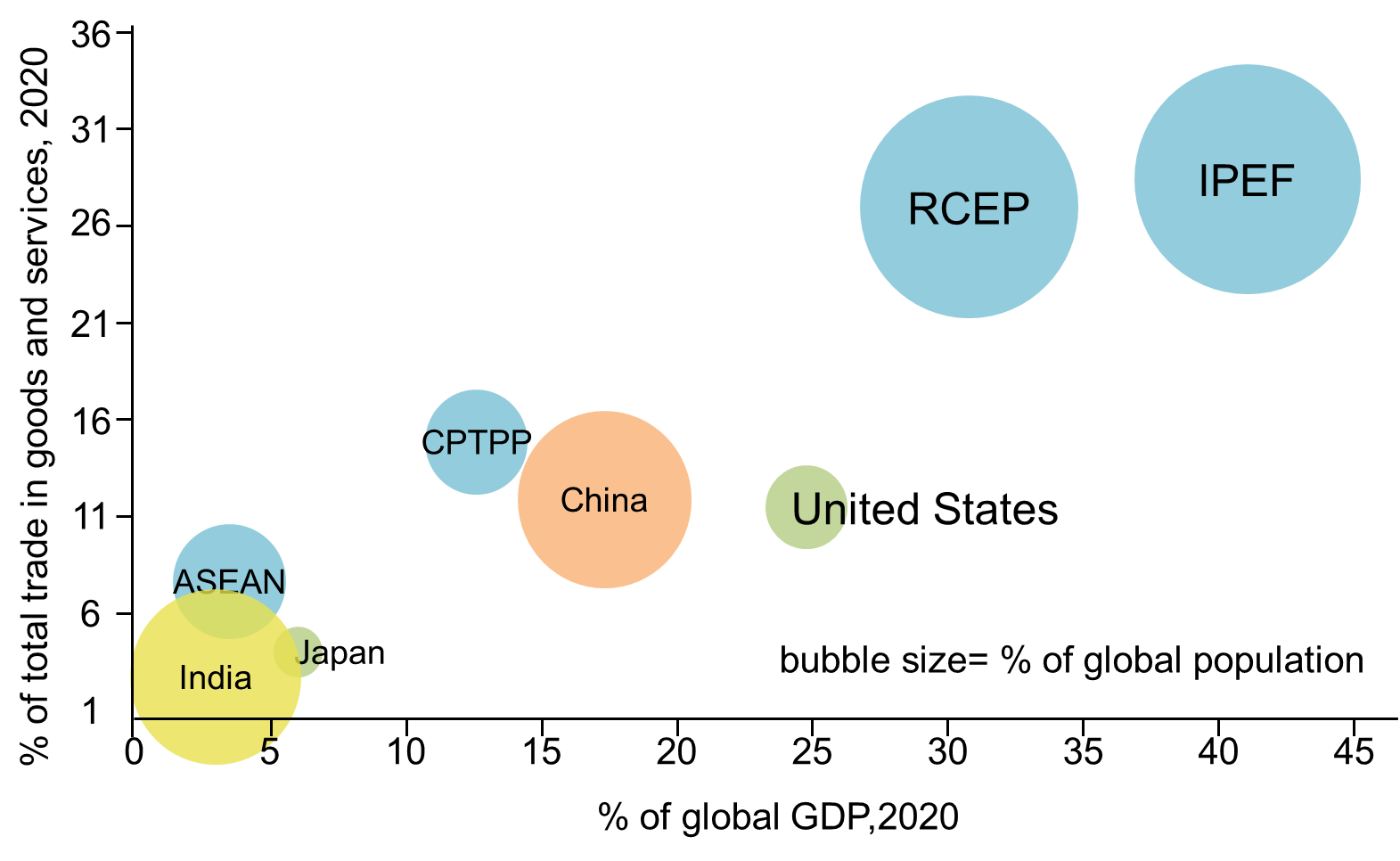

IPEF comprises a substantial share of global GDP (41%) and trade (28%) – higher than other multilateral agreements (Fig. 1). While IPEF can potentially benefit all members, it can especially boost and transform growth in ASEAN. Majority of ASEAN members in IPEF (i.e., Malaysia, Thailand, Indonesia, Philippines, Vietnam) have a lower income per capita so they can benefit from financial and technical cooperation. E.g., Vietnam has per capita of $2,786, significantly lower than average IPEF members’ per capita ($13,840) as of 2020.

Fig. 1: IPEF vs Other Multilateral Agreements

Source: Hitachi Research Institute based on the author’s diagram on How will Southeast Asia benefit from the Indo-Pacific Economic Framework?

Then these ASEAN nations can become channel for positive spillover effects to non-IPEF ASEAN nations of low economic development (Cambodia, Lao PDR, Myanmar). This will likely result in increased synergy from complementary, multilateral initiatives.

The paper points out that tangible results for lower-income ASEAN members can come if the IPEF can spearhead the following:

In ASEAN, digital trade is significant, but digital inclusion is a challenge. For example, Indonesia ranks low – 112 out of 131 countries – in ‘firms with website’ indicator in Network Readiness Index 2022, but in comparison Malaysia ranks better (72). Through IPEF, ASEAN members can seek technical assistance (with limited financial assistance) from other members with advanced digital ecosystems to expand digital usage among individuals, businesses, and governments (skills, infrastructure, transactions). This relates to IPEF’s pillar I and IV.

Currently, the U.S.’ foreign direct investment (FDI) in ASEAN is concentrated in Singapore, comprising 83% of its total in ASEAN-5 (Thailand, Singapore, Philippines, Malaysia, Indonesia). Moreover, it is largely concentrated in holding companies – 51% of its total in ASEAN-5. The paper mentions scope to expand and diversify the FDI from the U.S. FDI drives expansion and integration of global value chains (GVCs). In turn, GVCs with diversified and geographically dispersed suppliers can be a source of resilience. This is relevant with IPEF’s pillar II.

IPEF also covers clean energy, decarbonization (Pillar III). According to Asian Development Bank estimates, ASEAN members need $210 billion annually up to 2030 to finance investment in climate-compatible infrastructure. But as per ISEAS-Yusof Ishak Institute, only 10.6% ($56 billion) of total climate finance mobilized for developing countries during 2000-19 went to ASEAN (exception of Brunei, Singapore). This is a huge financing gap. In this context, paper sees scope for IPEF to fill this gap through direct financing or indirectly mobilizing private finance.

This paper raises topic of how ASEAN can benefit from IPEF with increased role of the U.S. But this is not an FTA and not increasing their access to the U.S. market. So, actual benefit to ASEAN is uncertain. For the U.S., it is a good move to build this economic bloc to balance China’s influence. But it is not going to take ASEAN away from China. However, a parallel movement that we can expect is ‘digital diplomacy’ anchored by the U.S., Japan, India. In this context, IPEF can open new doors with spillover effects on focus areas – be it trade, supply chain or clean energy – in the region.

ご紹介の文献URLはこちら/Click here for the URL of this literature

How will Southeast Asia benefit from the Indo-Pacific Economic Framework? | ODI: Think change

Ajay Kumar Airan

Deputy General Manager, Hitachi Research Institute Unit, MD Office, Hitachi India Pvt. Ltd.

Joined Hitachi in October 2011. Has 20 years’ experience in economic, geo-political, industry environment research and strategy support across Asia, ME, Africa. Holds Master of Business Economics from University of Delhi.