Latest economic forecasts for Japan, the U.S., Europe, and China, etc

The pace of recovery in advanced economies slowed down significantly in the second half of 2010, as the impact of government stimulus measures began to taper off. The international community failed to coordinate each member’s fiscal, monetary, and exchange rate policies, to some extent, due to domestic political confrontation in advanced countries such as the US, the UK and Japan. The recovery is fragile.

While the private sector continues to deleverage, the governments in the major advanced countries, except the US, are expected to turn to fiscal austerity in 2011. If the governments reduce their deficits too rigorously, the economy may fall into a contraction spiral. On the monetary side, the additional large-scale quantitative easing (QE2) is being implemented in the US. Some people are afraid that a large amount of money supplied to the market may flow into the high growth emerging economies, and that the QE2 increases the risks of violent fluctuation in prices in the commodity markets and the stock markets.

The world faces a historical turning point. The global imbalances due to over-consumption in the US and excessive savings in China are not sustainable. The world somehow has to restructure trade, currency, and financial systems. Though the emerging economies, especially China, are pressured to revalue their own currencies, they oppose such measures for fear of hurting their exports. Thus, the reduction of imbalances will be painfully slow, and the world economy continues to be unstable in the medium term. Especially, the advanced economies are sluggish, and full employment will not be achieved even in 2015.

The emerging economies will increase their presence with their high growth potential, as they will manage to avoid the risks of overheating. Their share in the world GDP will continue to increase, and the gap in income with the advanced economies will get narrower. The number of households in the middle-income class will rise. The demand for high value-added durable goods, like social infrastructure and automobiles, will increase especially in the emerging economies of Asia.

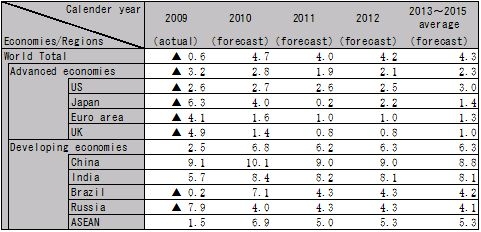

Our forecast for GDP growth rates in CY 2011 are 4.0% for the global economy, 2.6% for the US, 1.0% for the Euro Area, and 9.0% for China. Medium term growth rates for the world economy will accelerate from 3.0% average annual rate in the 1990’s, to 3.6% in the 2000’s, and 4.3% in the 2013-2015 forecast period, with growth driven by the emerging economies, like China

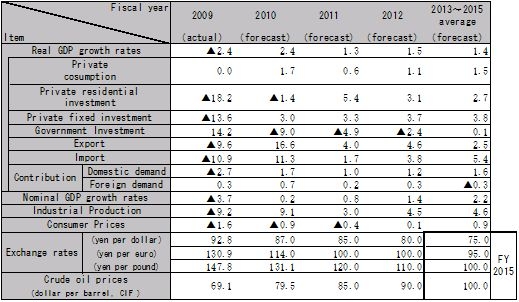

The Japanese economy has lost the recovery momentum. As corporate spending heads for abroad and household income expands little, domestic demand will hardly increase. In the medium term, Japan will have to draw down its past savings, as the baby boomers retire. While seniors come to consume more, saving rates will fall. The trade balances will turn to deficits in FY2015. The fiscal health is also strained, and it is necessary for the government to increase the consumption tax rate by at least 8% to balance the fiscal budget. We assume that the consumption tax rate will be raised by 3% from 5% to 8% in FY2014. Japan will grow 1.3% in FY 2011. The exchange rates will be 85 yen per US dollar and 100 yen per euro, and crude oil price will be 85 dollar per barrel in FY2011. In the medium term, the real GDP growth rate will be around 1.5%, and the yen will continue to remain strong.

The products and the processes where Japan has lost its competitiveness, should be handed over to the emerging economies. However, Japan should follow the suit of the US, and make every effort to retain a high productivity manufacturing sector, in which Japan has a comparative advantage thanks to its high level of knowledge in science, technology, and quality. However, the manufacturing sector will absorb less labor due to the rise of labor productivity. The creation and development of growth industries like health care and nursing, education, and business services are critical.

Note: Japanese numbers above are on calender year basis, but those in the table below are on a fiscal year basis

Source: Compiled by HRI from various sources. Forecasts by HRI

Source: Compiled by HRI from Cabinet Office "Natural economic accounting" and other sources. Forecasts by HRI