Latest economic forecasts for Japan, the U.S., Europe, and China, etc

Global economy stagnates without driving forces after stagflation

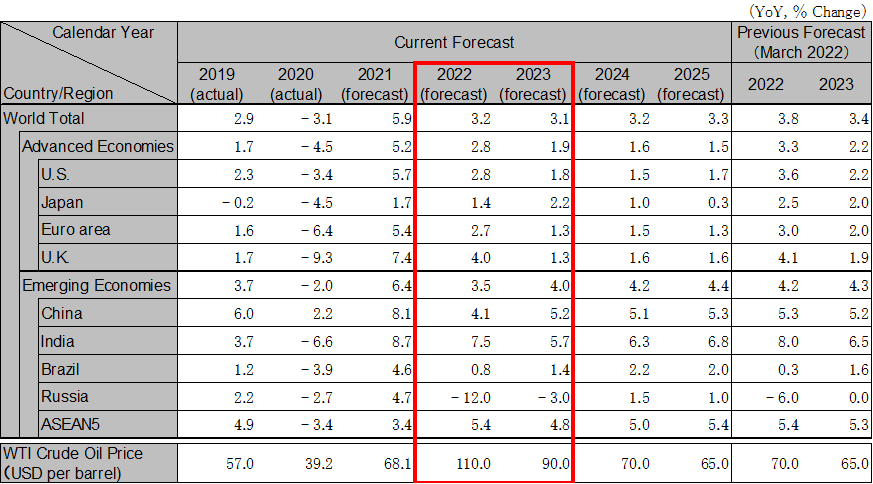

In 2022, the global economy will experience stagflation that means "high inflation and economic stagnation" due to high resource and food prices associated with the Ukraine crisis and sustained high inflation in the U.S., while Europe and China face economic slowdown. Inflationary pressures will spread to emerging economies, and monetary policy will be tightened to curb inflation in India and ASEAN countries as well as in Europe and the U.S. In 2023, inflation will slow down due to the end of the surge in resource prices. On the other hand, monetary tightening will slow down the U.S. and European economies. The recovery of the Chinese economy will be moderate, and the global economy will remain stagnant in the absence of driving forces. Global growth is forecast to be 3.2% in 2022 and 3.1% in 2023.

The U.S. economy will experience strong domestic demand in 2022, with inflation remaining at a 40-year high and upward pressure on service prices expanding. The diminishing real disposable income due to high inflation, and the Fed's interest rate hikes will put downward pressure on the U.S. economy in late 2022 and early 2023. We expect the Fed to continue to raise interest rates, with the policy rate rising to 3.5% by the end of 2022. Real GDP growth is projected to be 2.8% in 2022 and 1.8% in 2023.

The Euro area economy will slow in 2022 due to soaring energy prices following the Russian gas embargo. Although consumption was strong in early 2022 due to the calming of the COVID-19 infection, inflation has risen to its highest level since the inception of the Euro area and will remain high during 2022. The ECB plans to raise interest rates in July 2022. The UK economy will also slow through 2023 due to inflation and continued rate hikes. Real GDP growth in the Euro area is projected to be 2.7% in 2022 and 1.3% in 2023. Real GDP growth in the UK is projected to be 4.0% in 2022 and 1.3% in 2023.

China tightened its Zero-Covid policy in the early spring of 2022 due to an increase in infections, and the Shanghai lockdown, which lasted about two months until the end of May, caused a sharp slowdown in economic activities, including production, logistics, and consumption. Even after the lockdown is lifted, the recovery of domestic demand, particularly consumption and capital investment, will be slow due to concerns about jobs, income and the difficulties faced by small, medium-sized, and micro businesses. Restrictions on inter-city logistics will continue for the time being, and the effects of logistics constraints will remain until autumn. Although stimulus measures to promote infrastructure investment will support the economy, real GDP growth in 2022 is expected to decline to 4.1%, well below the government target. In 2023, the effects of the lockdown will run their course and the economy will recover, but the stimulus measures will also weaken. Real GDP growth is projected to be 5.2%.

While India’s economic recovery continues, inflationary pressures are increasing, especially in food and energy. Consumer prices have exceeded the upper end of the inflation target range near 6%, and interest rates were raised consecutively in May and June 2022. Another interest rate hike by the end of the year is also in view. Real GDP growth is projected to be 7.5% in FY2022 and 5.7% in FY2023. ASEAN’s economy has been recovering by taking a “Living with Covid-19” policy, but inflation is generally rising gradually, and the monetary policy has shifted from monetary easing to precautionary rate hikes. The spillover effects of China’s economic slowdown should also be noted. The real GDP growth rate of ASEAN5 is projected to be 5.4% in 2022 and 4.8% in 2023.

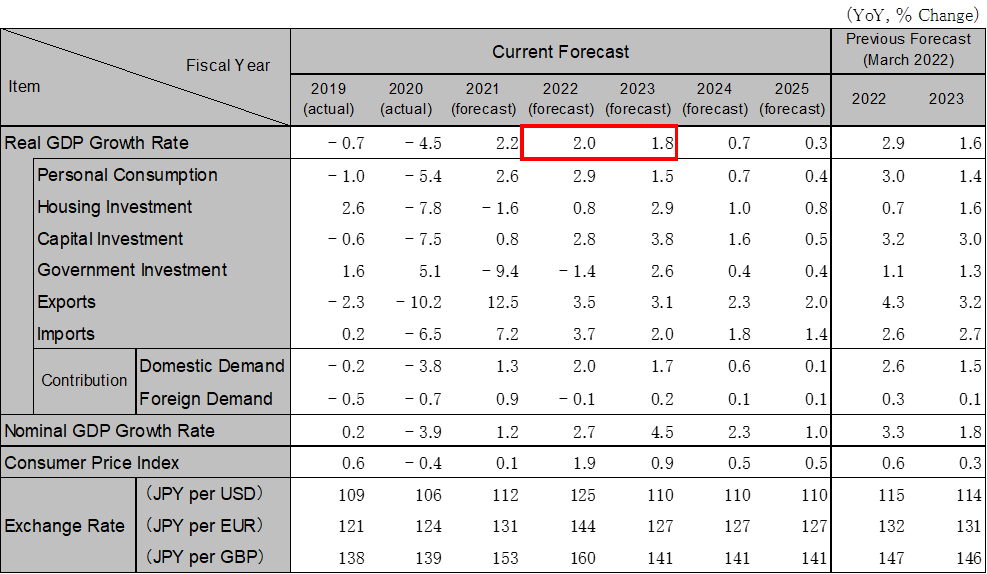

With the spread of COVID-19 vaccinations and the settling down of the infection, personal consumption is on a recovery trend. However, price hikes in a wide range of daily necessities, such as utilities, food, and rail fares put downward pressure on consumer sentiment. Capital investment will continue to recover, especially in the manufacturing sector, as a sense of equipment shortages is becoming apparent in many industries. On the other hand, soaring oil and raw material prices will put downward pressure on corporate earnings, and supply constraints due to a lockdown in Shanghai, China, and difficulties in procuring materials such as semiconductors will continue. With overseas economies on a slowing trend, export growth will be sluggish and economic growth will depend on domestic demand. Real GDP growth is projected to be 2.0% in FY2022 and 1.8% in FY2023.

Note: The figures above are calendar-year based. Accordingly, the figures of Japan are different from the fiscal-year based figures in the table below.

Source: IMF. Forecast by Hitachi Research Institute.

Note: Source: Japan Cabinet Office, etc. Forecast by Hitachi Research Institute.