Latest economic forecasts for Japan, the U.S., Europe, and China, etc

Global economic recovery continues, but supply constraints will not be fully resolved until 2023

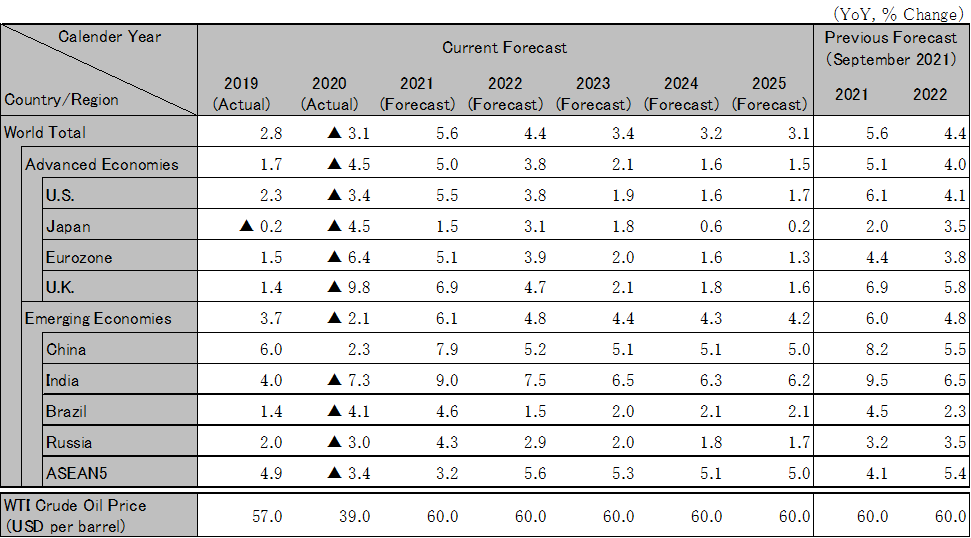

Although there are uncertainties associated with the spread of new COVID variants, the global economy will continue to recover in major countries and regions due to progress in vaccine dissemination and therapeutic drug development. The global GDP growth rate is expected to be 5.6% in 2021 and 4.4% in 2022. On the other hand, the effects of supply constraints, such as global shortages of semiconductors, and upward pressure on resource prices, are expected to remain in 2022, and improvement in the situation will be delayed until 2023. Interest rate hikes in the U.S. against the backdrop of rising inflationary pressures, along with worsening terms of trade and market turmoil in non-resource countries, are the main risks that hinder a sustainable global economic recovery.

The U.S. economy is expected to remain strong in 2022. We expect the Biden administration to enact the $1.8 trillion Build Back Better Act by early 2022, following infrastructure investments totaling $550 billion. Due to the effects of economic stimulus measures, household consumption expenditure and fixed investment will drive the economic recovery in 2022. The balance of supply and demand for goods will remain tight due to the economic recovery and shortage of materials, and inflation will remain high in 2022. The Fed will raise interest rates twice in 2022. Real GDP growth is expected to be 5.5% in 2021 and 3.8% in 2022.

The Euro area economy is expected to have a weak start in 2022 following the resumption of partial lockdown measures in some member states, which will restrain consumption in early 2022. Semiconductor shortages will persist in 2022, leading to a sluggish recovery in exports, while infrastructure investment through the recovery fund will accelerate. Inflation will rise to the historically highest level in the euro area, but is expected to subside by the end of 2022. Real GDP growth in the Euro area is forecast to be 5.1% in 2021 and 3.9% in 2022. In the U.K., the introduction of behavioral restrictions will be limited even after the spread of the new variants. Real GDP growth in the U.K. is expected to be 6.9% in 2021 and 4.7% in 2022.

In 2021, measures to combat infection and tighten real estate regulations and climate measures weighed on the economy through slowing consumption and the deteriorating real estate market, as well as coal and electricity shortages. 2022 is expected to see regulatory operations temporarily become more flexible under cautious policy management ahead of the Party Congress in the fall. The economy is expected to recover moderately as consumption and infrastructure investment pick up. On the other hand, the policy stance emphasizing the quality of growth and the importance of people's livelihoods, such as joint wealth, will be maintained, and a cautious policy stance on fiscal stimulus is expected to continue. Real GDP growth is expected to be 7.9% in 2021 and 5.2% in 2022. The real estate market faces the risk of long-term stagnation due to population decline.

India's economy has recovered due to progress in vaccination and the easing of restrictions on economic activity following the cessation of infection. ASEAN countries are also expected to recover from the decline in the summer of 2021 due to the progress of vaccination and the resumption of economic activities. The GDP growth rate of ASEAN-5 is expected to be 3.2% in 2021 and 5.6% in 2022. However, the risk of supply chain disruptions due to a resurgence of infections caused by new variants and the recurrence of tighter restrictions should be kept in mind.

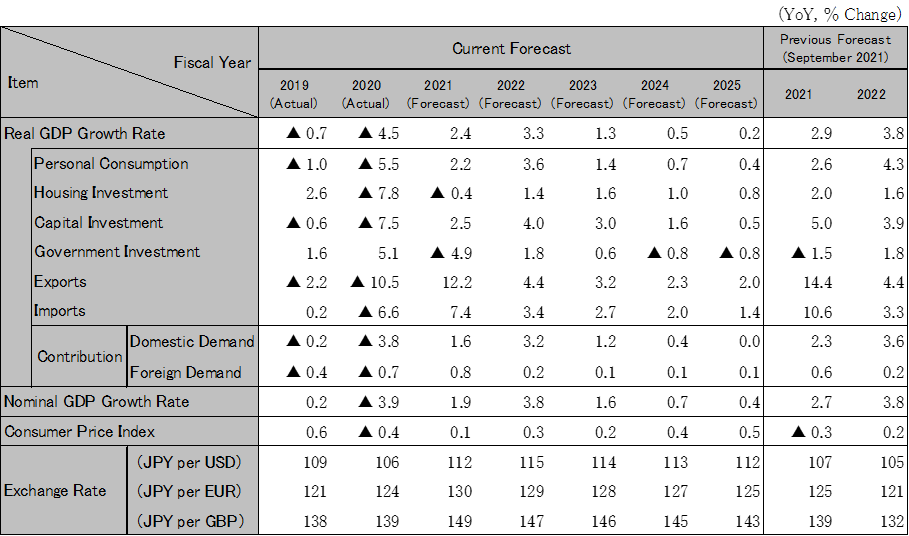

Mobility has increased due to the spread of vaccines and the lifting of the state of emergency. Consumer sentiment has also recovered and consumption has picked up, especially in the service sector, such as food and beverage and entertainment. The new administration organized economic measures with a supplementary budget of over 30 trillion yen. Measures to stimulate consumption, such as uniform benefits for child-rearing and low-income households, “GoTo” projects, and public works to strengthen the national land, are expected to support the economy in the first half of 2022. Exports are expected to remain resilient due to the sustained recovery in overseas demand, although supply constraints will remain, mainly in transportation machinery and semiconductors. Capital investment will continue to recover, but there is a risk that deteriorating terms of trade due to soaring crude oil will weigh on corporate earnings, particularly in the materials industry, and weigh on the economic recovery. The real GDP growth rate is expected to be 2.4% in FY2021 and 3.3% in FY2022.

Note: The figures above are calendar-year based. Accordingly, the figures of Japan are different from the fiscal-year based figures in the table below.

Source: IMF. Forecast by Hitachi Research Institute.

Note: Source: Japan Cabinet Office, etc. Forecast by Hitachi Research Institute.