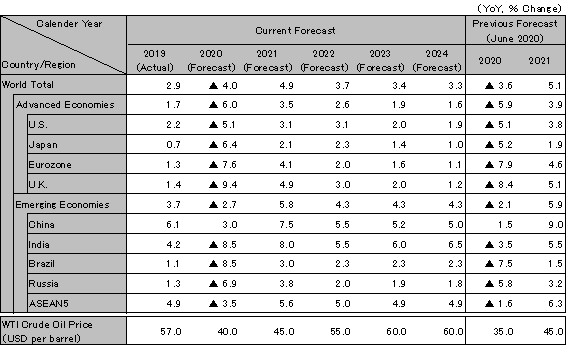

Latest economic forecasts for Japan, the U.S., Europe, and China, etc

Picking up from bottom, but weak recovery likely amid entrenched spread of coronavirus

An end to the pandemic is still not in sight, and there are growing disparities among countries in terms of new case numbers. The risk of a serious double-dip recession due to renewed large-scale economic shutdowns is narrowing. However, given that it will take some time for a vaccine to be developed and distributed, economic stagnation will likely continue, mainly in industries that are still subject to restrictions such as those involving face-to-face services. Global GDP growth is projected to fall sharply to −4.0% in 2020, and while we anticipate a rebound to 4.9% in 2021, GDP is unlikely to recover to pre-crisis levels until the second half of 2021 or later. Thereafter, we forecast growth in the low- to mid-3% range through 2024 (c.f. average growth of 3.8% in 2010-19).

After bottoming in Apr-Jun 2020, the US economy recovered in Jul-Sep, but the recovery has been weak due to a resurgence in new COVID-19 case numbers. We forecast zero growth in Oct-Dec due to the expiration of the economic stimulus package (fiscal cliff). A shutdown of the federal government was avoided at the end of September, but a large stimulus program worth $2 trillion is unlikely to be implemented until a new administration is in place. We also forecast zero growth for Jan-Mar 2021 given the potential turmoil surrounding election results during the period from the presidential election in November until the inauguration of the new administration in 2021. Assuming the new administration is led by Democratic candidate Joe Biden, the US economy should finally enter a recovery track from spring of 2021, when economic stimulus measures such as infrastructure investment are expected to be put in place, along with measures to fight the pandemic. The country’s potential growth rate will likely fall from 1.8% to 1.4%, and full employment is unlikely to be restored even by the end of 2024.

Economic activity has picked up since bottoming in April 2020, but GDP is well below pre-pandemic levels due to a resurgence in new COVID-19 case numbers. Until effective measures to counter the pandemic are found, consumption of contact-based services will likely remain sluggish, and companies will probably hold off on investments. The effects of measures for maintaining employment will also wane as such measures expire. Money from the EU recovery fund will be distributed from 2021, and this, along with existing fiscal and monetary policy measures, should bolster the region’s economy. We forecast real GDP growth of −7.6% for the eurozone in 2020 and 4.1% in 2021. Potential growth rate will likely slow to around 1%, compared with the pre-pandemic rate in the mid-1% range.

The Chinese economy has returned to positive growth since Apr-Jun 2020, driven by increased investment stemming from the implementation of aggressive fiscal and monetary policy measures. Cooling measures helped stabilize investment in real estate development, which was starting to look overheated, and infrastructure investment, which was temporarily suspended due to flooding in southern parts of the country, has resumed and will likely be concentrated heavily in the Oct-Dec quarter. Consumption, which has been notably slow to recover due to concerns over employment and income, should recover in 2021, backed by consumption stimulus measures such as the distribution of gift certificates as well as stabilizing employment conditions due to the execution of infrastructure projects. China’s growth rate is forecast to end up at 3.0% in 2020 and 7.5% in 2021. Growth is expected to fall gradually to the low 5% range from 2022, largely because China’s potential growth rate will likely decline due to a shrinking labor force, and divisions between the US and China will probably cause trade and capital inflows to stagnate.

The virus is continuing to spread in India, which suffered the biggest slump among major countries in Apr-Jun. Economic activity is gradually being restored but remains constrained in some regions. Rising inflation will probably hinder further monetary easing. We forecast growth of −8.5% in 2020 and 8.0% in 2021. Although India should return to a growth trajectory in the 5-6% range from fiscal 2022, it will probably continue to face difficulties with non-performing loans and other issues. We forecast negative growth for ASEAN countries except Vietnam in 2021. Thailand and Malaysia also face political instability. Over the medium term, we forecast growth of around 5% on a combined basis for the ASEAN-5 group.

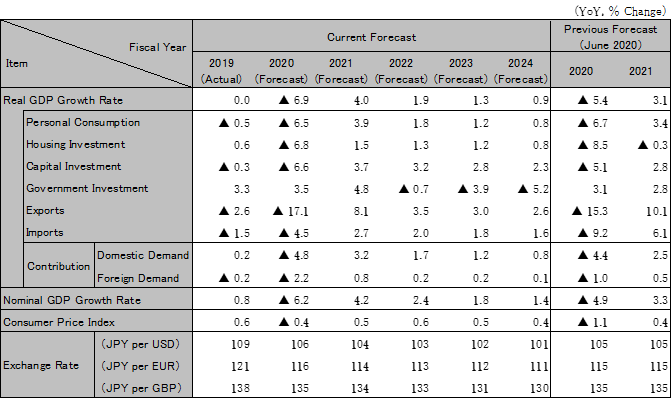

The Japanese economy has picked up since bottoming in May 2020, but the pace of recovery has been slow. Exports to China have recovered quickly, but those to the US and Europe will likely remain sluggish for some time. With overseas demand unlikely to recover quickly except for China, companies are turning cautious on new capital investment due to deteriorating earnings, low capacity utilization, and uncertainty over the economy. The employment environment has deteriorated, with the jobs-to-applicants ratio falling sharply in service industries such as hospitality and restaurants, and consumption has also been slow to pick up due to concerns over income. The Suga administration is looking to support the economy through measures such as extending various benefits and subsidies and increasing public works and government spending. GDP should recover to pre-pandemic levels in fiscal 2024, but Japan’s potential growth rate will likely fall to around zero. Further promotion of structural reforms through deregulation and so on will probably be needed for sustained growth.

Note: The figures above are calendar-year based. Accordingly, the figures of Japan are different from the fiscal-year based figures in the table below.

Source: IMF. Forecast by Hitachi Research Institute.

Source: Japan Cabinet Office, etc. Forecast by Hitachi Research Institute.