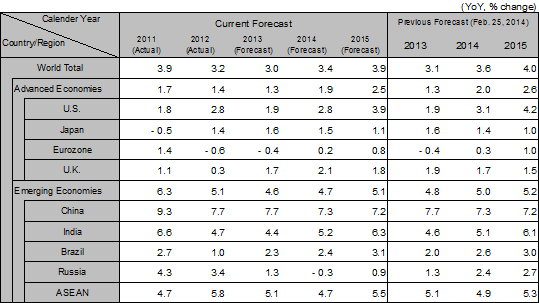

Latest economic forecasts for Japan, the U.S., Europe, and China, etc

Japan and the US are showing more robust signs of an economic upturn, while the global economy also continues to recover. Although the global real GDP growth is expected to increase from 3.0% in 2013 to 3.4% in 2014, emerging economies will remain stagnant with growth of 4.6% in 2013 and 4.7% in 2014. The standard scenario of this forecast assumes that there will be no military intervention by Russia into eastern Ukraine. However, with Russia cutting off its natural gas supply to Ukraine starting this summer, energy shortage is expected in the Eastern Europe regions that import natural gas from Russia via the pipelines in Ukraine. Sanctions by the West will be strengthened to include trade embargo against Russia in specific sectors (high-technology equipment, etc.), and this is likely to lead to a decline in exports to Russia from countries such as Germany and Italy. The risk scenario, in which the European economy, led by Germany, is adversely affected by Russia’s military intervention in eastern Ukraine and the suspension of trade and capital transactions between the West and Russia, cannot be ruled out. Should Thailand’s prolonged military coup and widespread protests disrupt the supply chain, this may also put a halt to the global production of automobiles, electronic devices, and other products.

In the US, investments are steady, and employment is increasing. Although the annualized growth for the January-March 2014 period over the previous quarter was -1.0% due to the cold wave, recovery is expected to speed up starting from the April-June period. At the meeting held on April 30, the FRB continued to reduce the amount of asset purchases by $10 billion in QE3 (third round of quantitative easing). Even though asset purchases will end at the meeting on October 29, the zero interest rate is expected to remain in effect until the first half of 2015, and this will help to stabilize the long-term interest rate at a low level and prevent the dollar from appreciating. Recovery of the housing market is also expected to accelerate the growth of the entire US economy.

In the Eurozone, the ECB is anticipated to implement further easing measures, such as an interest rate cut, at the board meeting on June 5, 2014. Against this backdrop, the entire Eurozone is expected to register a positive growth (0.2%) in 2014, the first time in three years. While the economy continued to mark positive growth for four consecutive quarters in the January-March 2014 period (0.8% growth compared to the previous quarter), the pace of growth has slowed down (1.1% growth in the October-December 2013 period). Compared to the high growth of 3.3% for the same period in Germany, growth was negative in Italy and Portugal. Prolonged economic stagnation is expected in the Southern European economies.

In China, although 2014 marks a decline for three consecutive years from 7.7% in 2012 and 2013 to 7.3%, growth will nonetheless be maintained at the 7% level. While giving priority to structural reforms, the Chinese government also announced at the National People’s Congress in March policies to prevent economic slowdown, including an economic growth target of about 7.5%. The aim is to implement policies with the minimum growth set at 7.2%. To prevent economic slowdown caused by external factors, the government announced small-scale economic measures on April 2, which include accelerated growth in railroad construction, accelerated reconstruction of barracks in urban areas, and extended tax benefits for small-sized businesses.

India is expected to gradually accelerate growth to 5.2% in 2014 and 6.3% in 2015. At the general election held on May 16, 2014, the Bharatiya Janata Party (BJP) won a sweeping victory with a single-party majority. Expectations toward future economic growth have led to a rise in stock prices and a rebound in the Indian rupee after the sharp decline since May 2013. Commitments made by the new prime minister Modi (employment creation, attracting foreign direct investments, infrastructure development, etc.) will be implemented starting from the northern states, where the BJP is in power.

Japan registered positive growth for five consecutive quarters in the January-March 2014 period with an annualized growth rate on previous quarter of 5.9%. The high growth is attributable to the rush demand among personal consumption before the rise in the consumption tax rate from 5% to 8% with effect from April. A growth in capital investment against the backdrop of improved corporate earnings also contributed to the economic upturn. While a reactionary drop in consumer spending at a level similar to the consumption tax increase in 1997 is expected, it is likely that the economy will continue to recover with measures such as the front-loading of public works. Unemployment rate and the jobs-to-applicants ratio have returned to the level prior to the financial crisis in 2008, achieving almost full employment. Labor shortage is already observed in the construction and some other industries. According to the Cabinet Office, the GDP gap arising from the last-minute demand in the January-March 2014 period is estimated to be -0.3% (compared to the potential GDP). With the continued recovery of the economy, it is anticipated that the deflationary gap will be eliminated by FY2015. Wages and commodity prices will rise more readily, and it would be possible to achieve the 2% inflation target set by the Bank of Japan’s Governor Kuroda.

Note: Since the figures above are based on the calendar year, the figures for Japan are different from the fiscal-year based figures in the table below.

Source: IMF. Forecast by Hitachi Research Institute