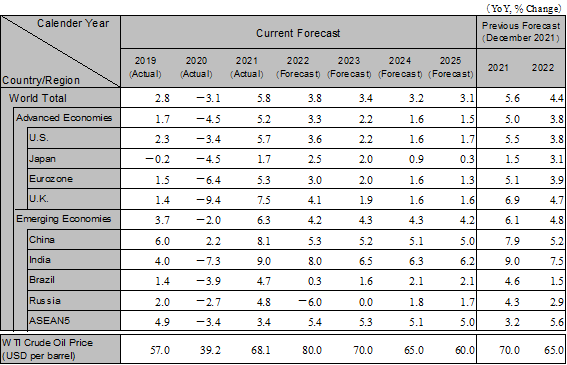

Latest economic forecasts for Japan, the U.S., Europe, and China, etc

Growing Uncertainty in the COVID-19, Economy, and Inflation Trilemma and Geopolitical Risks

The world economy in 2022 will face a difficult year in which it will be required to depart from the "trilemma" situation of (1) COVID-19 suppression, (2) economic recovery, and (3) inflation control. In Europe and the U.S., the re-emergence of COVID-19 peaks out and the economies remain strong, but the challenge will be to curb rapidly rising inflation. In China, inflationary pressures are limited, but the pace of economic recovery will slow if the zero COVID-19 policy is prolonged. Japan's economy remains sluggish, especially in consumption, despite relative containment of infection. Each country and region has its own set of challenges with different priorities, and economic uncertainty remains. In addition, the Ukraine crisis is adding to the growing uncertainty. Global growth is projected to be 3.8% in 2022 and 3.4% in 2023.

In 2022, the U.S. economy will continue to grow with strong domestic demand as COVID-19 peaks out. Investments under the Infrastructure Investment and Jobs Act will boost the economy. Although the Build Back Better package will inevitably be significantly reduced, large-scale economic stimulus measures are no longer necessary as the self-sustaining economic recovery accelerates. The Fed will raise the policy rate by a cumulative 1.5% during 2022, starting in March 2022. Quantitative tightening is also expected to begin in June 2022. Real GDP growth is projected to be 3.6% in 2022 and 2.2% in 2023.

The Eurozone economy starts off weak in 2022 due to the re-expansion of the COVID-19 infection. Consumption will pick up after March 2022 as the infection peaks out. On the other hand, the war in Ukraine is the biggest economic risk and will depress the Eurozone economy through higher energy prices and deteriorating sentiment. Eurozone inflation is at risk of remaining high due to rising energy prices. The ECB will not raise interest rates before the end of 2022. The U.K. started raising interest rates at the end of 2021 and will continue in 2022 due to strong economy and inflationary developments associated with tight labor supply and demand. Real GDP growth in the Eurozone is projected to be 3.0% in 2022 and 2.0% in 2023. Real GDP growth in the U.K. is projected to be 4.1% in 2022 and 1.9% in 2023.

China is strengthening its "zero COVID-19 policy" in the face of increasing transmission of COVID-19. This policy is the signature policy of the Xi Jinping administration and will be thoroughly strengthened until the Party Congress in the fall of 2022. However, the risk of the spread of infection remains, and prolonged implementation of the zero COVID-19 policy could lead to a downturn in consumption, production, and other economic activities. Monetary easing, fiscal support such as tax cuts for small and micro enterprises, guidance to promote local infrastructure investment, and deregulation related to the real estate sector are expected to be implemented. At the National People's Congress in March 2022, the government proposed a growth rate target of "around 5.5%" for 2022, emphasizing its focus on stable growth. Real GDP growth is projected to be 5.3% in 2022 and 5.2% in 2023.

India's economic recovery continues with limited activity restrictions and increased fiscal spending. Core consumer prices, excluding energy and food, are hovering near 6%, the upper end of the inflation target range, and we expect the implementation of an interest rate hike within 2022. Real GDP growth is projected to be 8.0% in FY2022 and 6.5% in FY2023. ASEAN's recovery will basically continue in 2022 despite remaining disparities in economic recovery among countries. However, there are risks in the re-imposition of activity restrictions due to the rapid spread of new mutant strains, and the stalling of the Chinese economy.

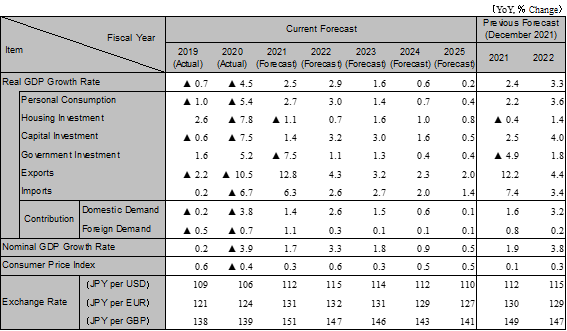

With the spread of Omicron strains passes the peak, restrictions on domestic economic activity eases, and the economy will recover in 2022, especially in consumer spending. However, there is a risk of downward pressure on consumer sentiment due to the continuing trend of voluntary restraint in going out and soaring prices of daily necessities such as utilities and food. Capital investment will recover mainly in the manufacturing sector due to increased demand overseas, but soaring crude oil and raw material prices will put downward pressure on corporate earnings, and there are disparities in the degree of recovery among industries. Supply constraints, such as difficulties in procuring semiconductor components, are improving, but the impact will remain through 2022. The Kishida administration's economic stimulus measures will support the economy from spring 2022 onward, but the scale of the measures is not sufficient and the GDP gap remains large. Real GDP growth is projected to be 2.9% in FY2022 and 1.6% in FY2023.

Note: The figures above are calendar-year based. Accordingly, the figures of Japan are different from the fiscal-year based figures in the table below.

Source: IMF. Forecast by Hitachi Research Institute.

Note: Source: Japan Cabinet Office, etc. Forecast by Hitachi Research Institute.