Latest economic forecasts for Japan, the U.S., Europe, and China, etc

2023 is a turning point for inflation and monetary policy. Economy will recover in 2024 after a standstill

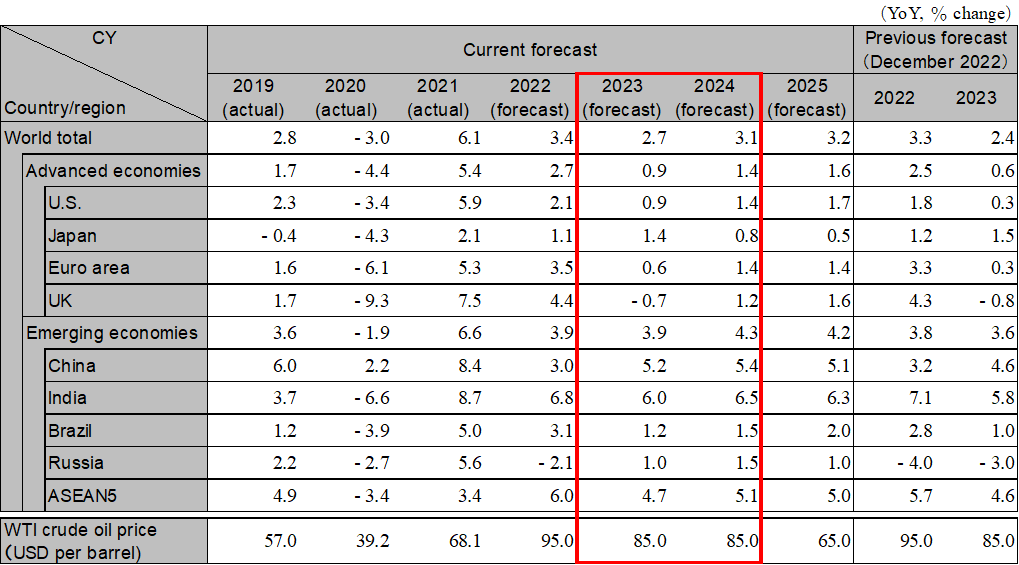

The global economic recovery, after stalling through mid-2023, gradually accelerates from the end of 2023 to 2024 against the backdrop of stabilizing inflation and monetary policy shift (end of interest rate hikes). Global growth will slow from 3.4% in 2022 to 2.7% in 2023, then will accelerate to 3.1% in 2024. The possibility of an economic upswing in 2023 due to a rapid recovery in China should be kept in mind, as it could trigger renewed supply constraint pressure and prolonged inflation, as well as the risk of an economic stall in the second half of 2023 due to continued tightening in the U.S.

The U.S. economy continues to show a weak recovery in consumer spending and capital investment, but so far, employment remains resilient. On the other hand, corporate business confidence has deteriorated, especially in the manufacturing sector, following the Fed's interest rate hike. Deterioration in employment is likely to become apparent by mid-2023. Inflation is expected to halt its rise and gradually decline toward the end of 2023. We expect the Fed to ease the pace of rate hikes, with the policy rate rising to the low 5% range in May 2023 before remaining unchanged. The risk is economic overkill with additional interest rate hikes as inflation goes up again. Real GDP growth forecasts are 0.9% in 2023 and 1.4% in 2024.

Inflation has continued to dampen consumption in major Euro area countries. On the other hand, the economic downturn in 2023 will be mild, as business activities recover in response to the decline in natural gas prices since the beginning of 2023 and the turn to recovery in the Chinese economy. The focus of price increases has shifted from energy to food products, whose prices remain high. The ECB is expected to raise its deposit facility rate to the low 3% range. The UK economy was off to a tough start in 2023 due to strikes after the end of 2022. High inflation and rising interest rates will lead to sluggish domestic demand and a recession in 2023. Real GDP growth forecasts for the Euro area are 0.6% in 2023 and 1.4% in 2024. Real GDP growth in the UK is projected to be -0.7% in 2023 and 1.2% in 2024.

Increase in the movement of people has been seen in China as a result of the COVID-19 policy shift. Although the economy will continue to expand in the first half of 2023 due to a recovery in consumption of face-to-face services, there is a risk of re-imposition of restrictive measures due to a surge in infections in some regions. In the second half of 2023, social and economic normalization will proceed as the spread of the infection is over and the period of coexisting with the coronavirus takes hold. The growth rate target is around 5%, with emphasis on consumption recovery and employment improvement. Although the real estate market continues to stagnate, the risk of a financial crisis is low. Real GDP growth is projected to be 5.2% in 2023 and 5.4% in 2024.

In India, inflationary pressures remain, but prices are expected to gradually stabilize due to lower import costs, especially resource prices, and interest rate hikes are expected to pause in the spring of 2023. Growth in FY2023 will remain resilient due to increased domestic demand, mainly from infrastructure investment. Growth forecasts are 6.0% for FY2023 and 6.5% for FY2024. ASEAN economies will be generally firm, and interest rate hikes in each country will be paused by mid-2023. While inbound demand is expected to increase, there are risks of downward pressure on domestic demand such as investment due to higher interest rates and downward pressure on exports due to a slowdown in Europe and the U.S. Growth is projected at 4.7% in 2023 and 5.1% in 2024.

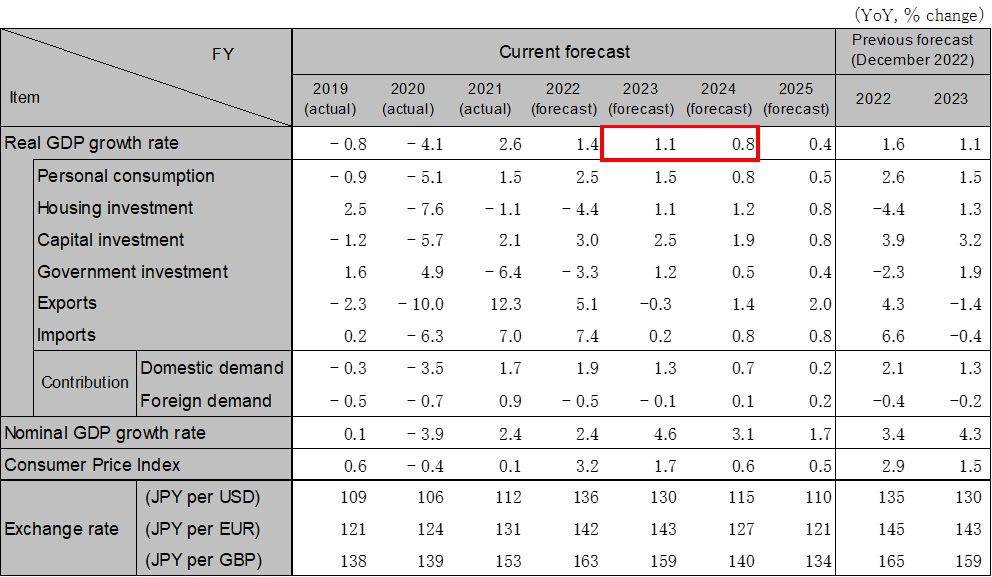

Consumption is firm on the back of government travel support measures and a recovery in inbound travel. Consumer sentiment is expected to improve due to the recovery of real wages, as the labor unions demand a wage increase of 3-6% in the annual spring wage negotiations considering rising prices. Under the new regime, the BOJ may modify or eliminate its yield curve control by manipulating long-term interest rates in 2023 in response to increased market pressure for monetary policy normalization. Recovery of capital investment will be slow due to deteriorating business conditions in the manufacturing sector caused by the slowdown in overseas economies. The price hike of crude oil and raw materials has slowed but remains high, and economic recovery will depend on domestic demand. The pace of economic growth will be moderate. Real GDP growth will be 1.1% in FY2023 (1.4% in CY2023) and 0.8% in FY2024 (0.8% in CY2024).

Note: The figures above are calendar-year based. Accordingly, the figures of Japan are different from the fiscal-year based figures in the table below.

Source: IMF. Forecast by Hitachi Research Institute.

Source: Japan Cabinet Office, etc. Forecast by Hitachi Research Institute.