Latest economic forecasts for Japan, the U.S., Europe, and China, etc

Global economy at a standstill in 2023 as inflation peaks out but lacks a driving force

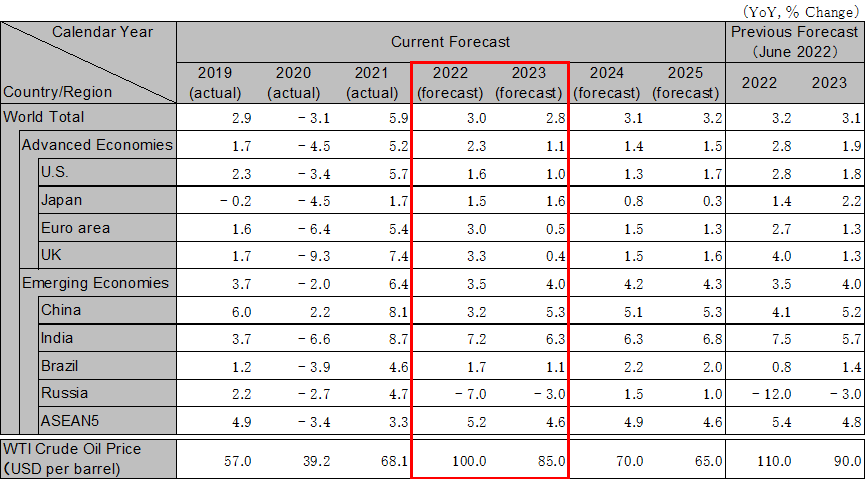

In 2022, the global economy will be depressed by continued high inflation in many countries, including soaring resource and food prices and rising goods prices and wages in the U.S. Inflationary pressures will spread to emerging economies, and interest rate hikes will accelerate in India and ASEAN countries, in addition to Europe and the U.S., to control inflation. Inflation will gradually slow down in 2023, mainly due to the easing of supply and demand and a consequent lull in the surge in resource prices. Tighter monetary policy will slow down the Western economies, and China's economic recovery will be sluggish due to slowing external demand and persistent weakness in the real estate market. With the absence of a driving force, the global economic recovery will stagnate. Global GDP growth will be 3.0% in 2022 and 2.8% in 2023.

The U.S. economy will slow in 2022 due to higher interest rates and prices. The highest inflation in 40 years will gradually dissipate by the end of 2022. The Fed will continue to raise interest rates significantly, with the policy rate rising to the low 4% range at the end of 2022 before remaining unchanged for until end of 2023. The Fed's rate hike will result in low growth in the U.S. economy through 2023, but a recession will be avoided because consumption will remain strong. Real GDP growth is projected at 1.6% in 2022 and 1.0% in 2023.

The Euro area economy will slow down due to higher energy prices following the disruption of natural gas supplies from Russia. Inflation will remain high and consumption and investment will decline, leading to stagflation from the end of 2022 to the first half of 2023. Production curbs in Germany and other major countries due to resource shortages pose the risk of further economic deterioration. The UK economy will also slow due to high inflation and rapid interest rate hikes. Real GDP growth in the Euro area will be 3.0% in 2022 and 0.5% in 2023. Real GDP growth in the UK is forecast to be 3.3% in 2022 and 0.4% in 2023.

China will continue its “Dynamic Zero-COVID” policy for the time being. Production and logistics activities have normalized since the Shanghai lockdown was lifted, but consumption recovery has remained slow mainly due to employment uncertainty. Consumption recovery will continue to be slow because of the new waves of infection in some cities in September and the implementation of a lockdown. After the party congress, the economy will be supported by the stimulus package's promotion of infrastructure investment, but GDP growth will slow to 3.2% in 2022, well below the government target. In 2023, the impact of the 2022 lockdown will run its course and the economy will recover, but the effects of the economic stimulus measures will also weaken, and GDP growth is forecast at 5.3%.

The Indian economy is recovering, but inflationary pressures are increasing, especially in food and energy. Consumer prices are above the upper end of the inflation target range of 6%, and the RBI has been raising interest rates continuously. India's economic growth rate is projected to be 7.2% in FY2022 and 6.3% in FY2023. The ASEAN economies are recovering steadily, but inflation is generally rising and interest rates have begun to rise in the ASEAN5 and Singapore. On the other hand, there is a risk of spillover effects from overseas economies, such as the slowdown in China, etc. We forecast growth rates of 5.2% in 2022 and 4.6% in 2023 for the ASEAN5.

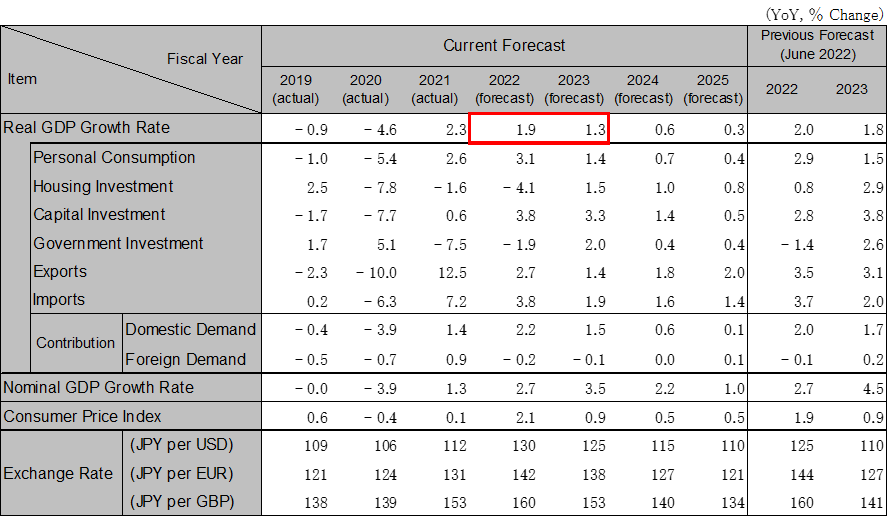

The easing of behavioral restrictions has led to a continued recovery in food service, entertainment, lodging, and other industries that were heavily impacted by COVID-19. However, the pace of economic recovery has remained slow due to price hikes in a wide range of items, particularly utilities and food, caused by soaring crude oil and raw material prices and the rapid depreciation of the yen. As for capital investment, improved corporate earnings have increased the appetite for DX/GX-related investment, especially in the manufacturing sector. Supply constraints on semiconductors due to the Shanghai lockdown in China and other factors are beginning to dissipate, but it will take time for production of transportation machinery to recover, and the supply-demand balance for some semiconductors is still tight. Exports will slow down through 2023 as overseas demand slows. Real GDP growth will be 1.9% in FY2022 (1.5% in CY2022) and 1.3% in FY2023 (1.6% in CY2023).

Note: The figures above are calendar-year based. Accordingly, the figures of Japan are different from the fiscal-year based figures in the table below.

Source: IMF. Forecast by Hitachi Research Institute.

Note: Source: Japan Cabinet Office, etc. Forecast by Hitachi Research Institute.