研究員お勧めの書籍を独自の視点で紹介

2014年4月2日

日本語抄訳:

建設機械大手である米キャタピラー社は、その90年に及ぶ歴史の中で様々な経営課題に対する業務改革を実施している。本書は同社が実施した業務改革の実際を示しており、例えば強固な販売網構築を通じた顧客獲得手法や小規模工場を活用した不況対策など、現在の日本企業が抱える各種問題を考える上でも大変優れた参考資料である。

During its nine decades of operations, Caterpillar (CAT) survived several business cycles by taking proactive and prolonged strategies. It faced stiff competition from its Japanese counterpart “Komatsu” during 1960s, which they managed through their unique and strong dealer network.

While Caterpillar was quickly following globalization way, Komatsu manufacturing capabilities and quality management were unmatchable. Thus CAT started focusing on operational excellence.

Prior to 1981, collective decision making and selling highly durable products at premium prices were the key operating principles of CAT. Leaders had to change operational strategy. As the challenges evolved, different leaders suggested different approaches that helped them dealing in tough times.

Fig.1: Evolution of Strategies and Leadership

Source: The Caterpillar Way, Company Website, HRI Analysis

画像を拡大する

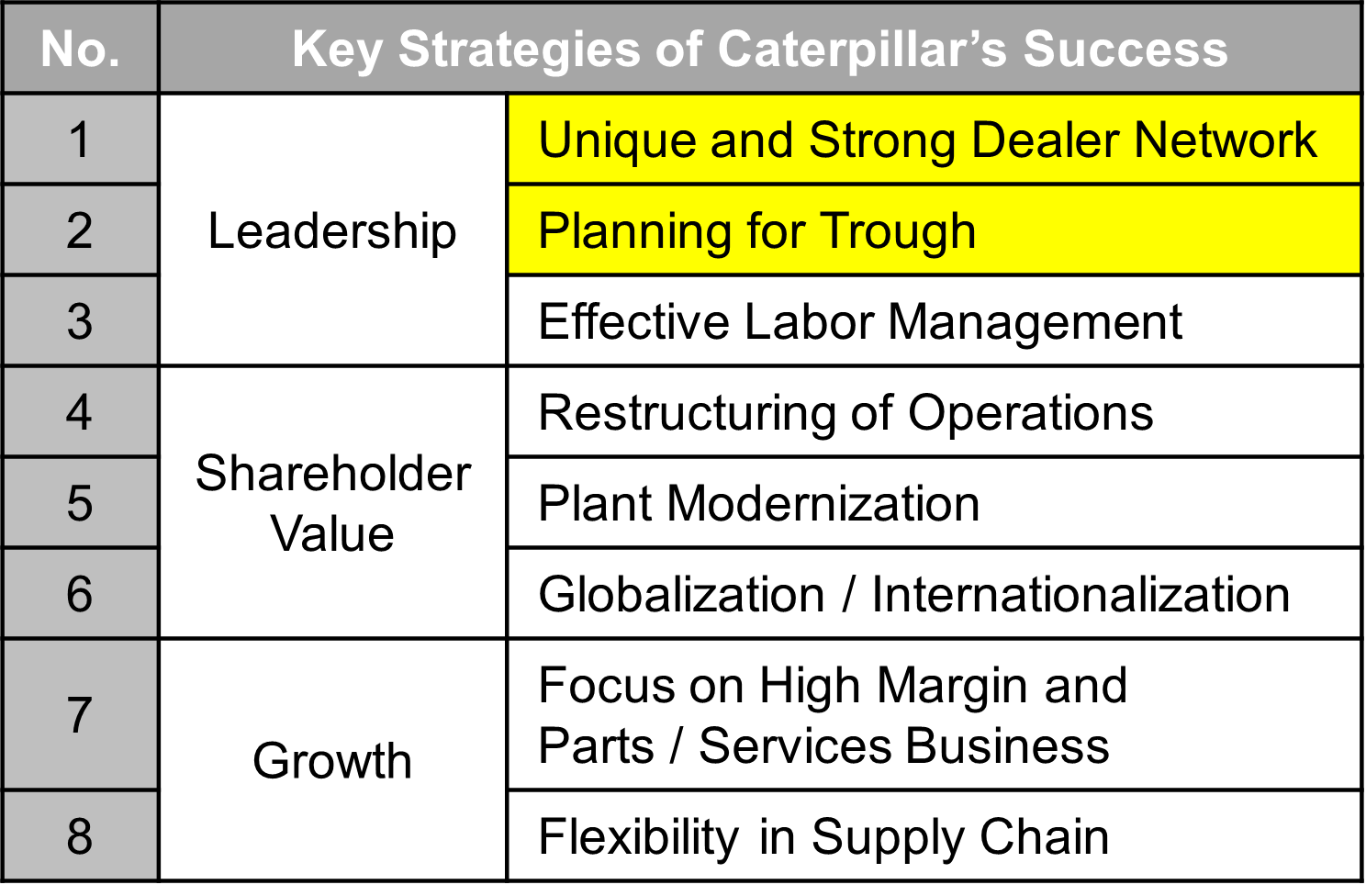

While some of the strategic choices are industry centric, CAT followed certain unique strategies which gave them a competitive edge over competitors. These are strong dealer network and proactive planning for trough (Fig.2).

In construction equipment industry, CAT has a competitive advantage in dealer distribution network, which includes 92 Independent dealers; 1,981 dealer branch stores; 1,332 dealer rental outlets employing over 140,000 people. The dealers which are chosen after rigorous analysis of reputation, connections and balance sheets are their brand building agents. Thus, CAT deploys “on the ground” representatives to support dealers to share knowledge, liaison and ensure close, frank and continuous communication. At the same time, the dealers support CAT in collecting steady feedback on critical and strategic areas such as product design, product durability, life-cycle costs, pricing strategy, financial market conditions and competitive moves. This two-way support system helps CAT to create long, strategic and profitable relationship with dealers. Currently, average duration of their dealer relationship is over 40 years, which other competitors find difficult to replicate.

Planning for trough: Jim Owens (CEO during 2004-10), considering the cyclical nature of business, suggested to plan for trough (adverse conditions). This implies company’s efforts to scale its activities up and down through increasing flexibility in operations.

Flexibility was planned through various moves such as

Fig.2: Key Strategies of Caterpillar’s Success

Source: The Caterpillar Way, HRI Analysis

Although flexibility in its operations is still questionable due to their nature of business which requires huge initial capital investments and high ratios of fixed to variable costs.

After dealing with 8 strikes during 1948-80 and a major one for 205 days in 1982, it faced continuous strikes in early 1990s leading to losses of over USD 2 billion. They adopted various effective ways to manage labor relations such as: automation of factories, proactive interactions with workers and avoid dealing through third party/union, and relocating production units in less unionized areas such as Southern part of the US

Corporate Strategy Group (CSG), launched in 1988, suggested reorganisation of operations into 17 semi-autonomous business units by decentralizing pricing, design and marketing decisions and making them accountable for their own profit & loss accounts. This led to identification of profitable and unprofitable units. Meanwhile, some unfavourable decision were taken such as outsourcing of input from vendors outside the US, downsizing and shut down of 5 manufacturing plants in the US. After reorganization, revenues tripled from USD 10.2 billion in 1991 to USD 30.3 billion in 2004.

In 1986, it introduced USD 1.8 billion plant modernization plan named “Plant With a Future” (PWAF) that included focus on computerization and automation of operations, movement away from batch production, cross training of workers. This move towards flexible manufacturing system reaped 20% return on this investment in 1992

With strong focus on Internationalization/Globalization, it increased its reach from 22 countries in 2004 to over 50 countries in 2010. Average growth of revenues increased from 3% (1963-83) to 10% (1983-2003) and 14% in eight years span of 2003-11.

Through proper planning for trough and focusing on high margin areas such as mining and parts/services business, CAT managed to earn consistent earnings and pay dividends to shareholders.

Although CAT managed to deal with tough times, the cyclical nature of business and high dependence on government regulations will keep influencing their future performance. Also, their decision making wasn’t optimal at all the times e.g. USD 8.8 billion acquisition of Bucyrus mining in 2011 when prices of global commodities was falling was not a big hit. Hasty decision of acquiring ERA/Sewei in China at high price of USD 677 million in November 2011 was not appreciated by investors and market. Thus, these instances give virtuous learnings to avoid making hasty business decisions in a difficult yet growing market like China.

Overall, this book is a good reference guide, one that is recommended to CEOs, CFOs, and COOs etc. of multinational companies operating in infrastructure/energy business. It highlights how the business can maintain profitability by optimising operations, taking calculated risks and proactively preparing for the worst conditions despite the cyclical nature of business and its exposure to governmental regulations. Their future strategies for China market will also act as learning for the senior management.